Â

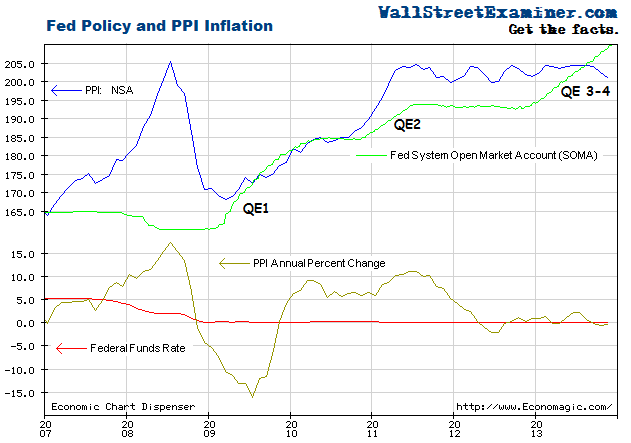

Fed Policy and Producer Price Index – Click to enlarge

The headline Producer Price Index for November was down 0.1%, in line with the consensus guess of economists.

What’s going on? Aren’t QE and ZIRP supposed to be inflationary? Isn’t the Fed shooting for 2% inflation? Yes, but wait! The Fed has been doing QE and ZIRP (Zero Interest Rate Policy) for nearly 5 years and for the past year and a half, there’s been no “inflation.†Zero. Zilch. Nada. And Japan has been doing some form of QE and ZIRP for over 20 years, and they’ve been stuck with deflation the whole time.

Get the picture? QE and ZIRP are deflationary. Apparently, central bankers don’t get it because it’s against their religion–the mystical belief that their policy of printing money and holding interest rates at zero will stimulate inflation if they just do it for long enough. There’s no basis for it in fact, but they go on believing. Faith is a critical element of central banking.  Central banking represents all of the world’s great religions–Christianity, Islam, Buddhism, Shintoism, Judaism, Zoroastrianism, Witchcraft, Devil Worship, and Economics, the last three especially so.

The Fed started ZIRP in late 2008 and began printing money had over fist with QE1 in early 2009. Producer prices had collapsed in 2008 after the commodity bubble blowoff earlier in 2008 that was an echo of the housing and credit bubble that grew out of years of easy central bank policy and lax regulation. We know how that ended. Â After the Fed cut rates to zero on the heels of the 2008 crash and started printing money, prices rebounded through QE 1 and 2, but only to their previous level. But look what happened with QE3 and 4 which began late in 2012. No inflation.

Here’s the problem. Money printing and ZIRP are great for asset inflation–bubbles, if you will. But economists do not count asset inflation as inflation. That’s right. Asset prices don’t count.