We recognize that this drawn out Greek drama is reaching a climax. By most reckonings, this weekend is decisive. Â

We have argued that Greece will have its debt relief, either through default or negotiation with the official creditors. We have argued that greater hardship is coming to Greek people. Â

It can choose a known and orderly type of pain and try to influence its distribution, or it can roll the dice for a chaotic collapse. This would likely concentrate the pain on those least equipped to cope with, namely the poor, sick, young and old. The creditors cannot escape the fact its loans to Greece cannot and will not be fully paid back. The Greece cannot escape the fact that to put the country on more sustainable and competitive footing, various reforms will have to be implemented. Greece will have to live within its meager means. Â

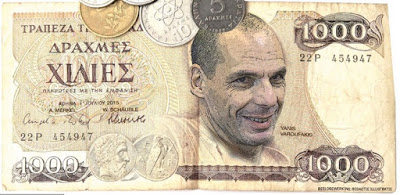

There has been much talk of a Greek exit from the monetary union as some kind of accident. It is no accident. After all, German Finance Minister Schaeuble reportedly has been pushing for it since the crisis first broke almost five years ago. European Commission President says detailed plans of a Greek exit have been drawn and readied. Rather than an accident, we think it would be folly. Â

Nevertheless, the risks of a Greek exit have risen. There are many questions as it would be an unprecedented event. We try to offer preliminary answers to some frequently asked questions about a potential Greek exit.

1. Â What is the sequence of events that could lead to Greece’s departure from EMU?Â

If Greece and its creditors cannot reach an agreement this weekend, the ECB could claw back the Emergency Liquidity Assistance authority granted to the Greek central bank. This would likely force Greece to provide a new means of liquidity. This would become the basis for new national money. Â We have suggested two steps that the Greek government may take that would signal a preparation for such an eventuality. First, Greece can make good on its threat to challenge the ECB’s ELA authority. The European Court of Justice recently gave the ECB wide berth in terms the conduct of monetary policy. ELA is not a function of its monetary policy. One way to challenge this would be a legal case. The other way is to defy the ECB. Â This would likely require a second measure, and that is to replace the current governor the central bank with one that would be more accountable to the Syriza-led government. This would also give the government greater control of the country’s reserves (gold and hard currency) that become all the more important on a Greek exit. Â