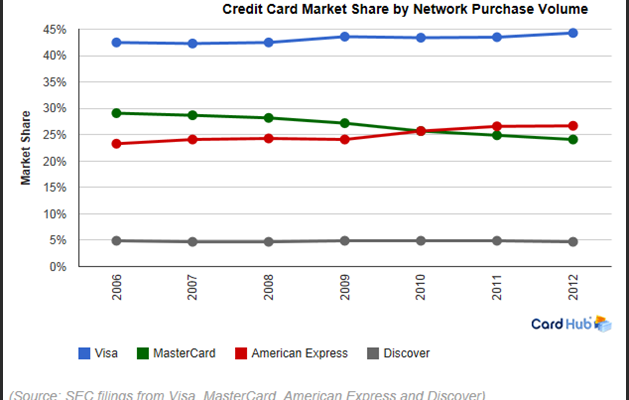

In true oligopolistic fashion, the credit card industry is dominated by just four players:  Visa (V), MasterCard (MA), American Express (AXP) and Discover (DFS). For instance, here’s a look at the respective market shares over the 2006 to 2012 period:Â

In rough numbers Visa controls 45% of the market, American Express takes just over 25%, MasterCard manages just less than 25% and Discover has stayed consistent with about 5% of the network purchase volume. For those doing the quick math, it’s apparent that these four companies effectively are the market – if you want to use a credit card, these are your options. In turn, these companies act as toll collectors between merchants and consumers.

Of course there is a plethora of regulation and ligation risks, but take a trip to nearly any place of business and it’s easy to see why the credit card companies make money. Furthermore, while we know these charge cards to be almost ubiquitous, this does not necessarily hold in the rest of world. Indeed, according to MasterCard’s most recent annual report roughly 85% of worldwide transactions are conducted in cash. This would seemingly indicate that there is plenty of room for each company to grow – even if the respective market shares don’t shake up at all, there could literally be four winners in this globally-expanding base.

With that general growth thesis in mind, we thought that it would be enlightening to take a look at the particular business dynamics of each company through the lens of F.A.S.T. Graphs™. Â

Visa

This San Francisco based global payments giant is by far the runaway leader in credit card volume market share. Visa provides services in more than 200 countries and territories, enabling consumers to use digital currency instead of cash and checks.  Capable of handling more than 24,000 transactions per second (that’s over 2 billion a day) Visa does not actually issue cards, extend credit or set rates and fees – instead, the company collects fees from financial institutions based on volume. Interestingly, only about 30% of Visa’s payment transactions are credit, while the remaining 70% is derived from debit and prepaid cards.

Morningstar analyst Jim Sinegal describes Visa’s moat in the following way:

“A powerful network effect is responsible for Visa’s wide economic moat. A trusted brand is important to users of payments systems, and Visa has spent billions of dollars over decades on this intangible asset.â€

As a result the business has been steadily growing and shareholders have been continuously rewarded. Over the past 6 years Visa has grown operating earnings per share (orange line) by over 24% a year. In addition, the dividend (pink line) has grown at an even quicker pace jumping from $0.10 a share in 2008 to today’s mark of $1.60 a share. Still, the payout ratio remains quite low at just 18% of next year’s projected earnings, with a current dividend yield of 0.7%. Further, notice that current price-to-earnings ratio stands at about 27.9 versus a normal P/E ratio of about 22.1 during this time period.