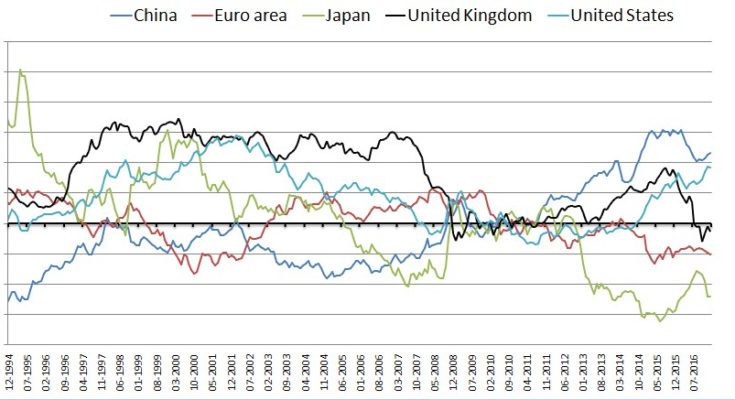

BIS REER: Yuan is still significantly overvalued, while Yen is undervalued

Source: BIS, Chart by: Tiptv.co.uk

The Bank for International Settlements (BIS) publishes a monthly data on the nominal exchange rates and real effective exchange rates in two different weighting patterns – Broad and Narrow weights. The BIS effective exchange rate (EER) indices cover 61 economies, including individual euro area countries and, separately, the euro area as an entity.

The chart below is the real effective exchange rate – Broad indices with data from 1994. A reading above 100.00 suggests the currency is overvalued and the reading below 100.00 means the currency is undervalued. The currency is at the fair value if the reading stands at 100.00.

China: Yuan is still the most overvalued currency. The currency ended 2016 with the biggest annual loss since 1994. China has a huge current account surplus. In Q3 2016, the surplus rose to $69.3 billion in the third quarter, up 8% year-on-year. That amounts to 2.4% of GDP. So the strength in the currency is logical. However, China is rebalancing its economy from investment driven to consumption driven, which means in the long run the trade surplus will slowly dwindle. Thus, there is little doubt the Yuan would continue to slide in the long-run. The PBOC too desires the same, but is not comfortable with the speed of the decline. Moreover, faster the speed of the decline more is the damage to the economic confidence.

Euroarea: The Euro is undervalued by about 10%. Note that it is not the German Euro index, but an aggregate for all the Eurozone nations. Hence, it would be wrong if we say the currency would strengthen due to the fact that Germany runs a huge current account surplus. Moreover, the rise of populism is bad for the common currency. So don’t be surprised to see the index slide further in the coming months. Â

Japan: The Japanese Yen is the most undervalued currency in the pack. The Japanese Ministry of Finance (Mof) data released earlier this month showed the country attained its second-biggest current account surplus on record in 2016. Hence, there is potential for a sharp rise…especially if the Trump Bump Slumps in the coming days. No wonder, Japan’s former top currency official Eisuke Sakakibara, also known as Mr. Yen, sees the Dollar-Yen pair deflating to 100.00 levels by the year-end.