Scott Sumner is dead wrong about the housing bubble last decade. Here is his view on the matter, recently published on his interesting blog, The Money Illusion:

There are two powerful pieces of evidence against the claim that the US housing market was overvalued. First, many who made that claim also said the same thing about housing markets in Canada, Australia, the UK, and other countries. And yet many of those other countries did not crash. Even worse, America’s housing market has mostly recovered, and yet I see almost no one currently saying “America’s in a huge housing bubble, and when it crashes we’ll have another Great Recessionâ€. So why continue to claim the 2008 recession was caused by a housing bubble that no longer even looks like a bubble at all?

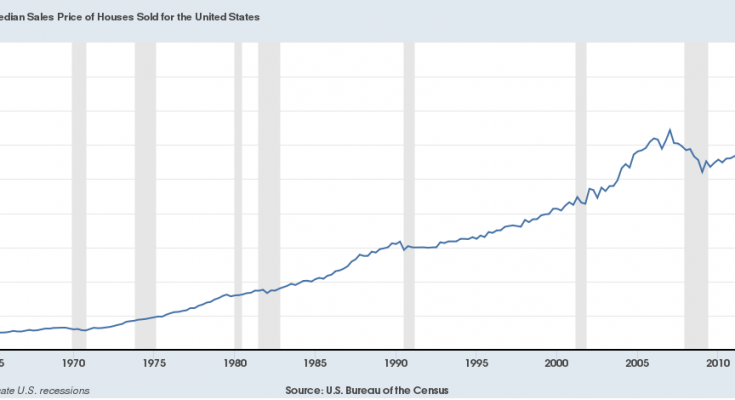

The problem with his analysis is that last decade, mortgage rates were far higher, while prices were similar to current prices in the bubble states. Yes, if you look nationally, as seen in the chart below, prices are higher everywhere now. But that figure is deceptive. The median price in California in the bubble was around $500,000 and that is about where we are now. It is in the bubble states where prices were high. Those were mainly California, Florida, Arizona and Nevada.

|

Nationally, prices are higher now but the housing bubble was confined to 4 states last decade. |

And remember, Robert Shiller has said we have seen overheating in housing since 2012!

So, the bubble consisted of people who were given low teaser rates in certain states, and would be unable to pay once those rates went away. What actually happened in the bubble states is that when the crash came, many mailed in the keys, but in many wealthier neighborhoods, there was no attempt to foreclose right away, as the value of the housing was more important to banks than foreclosing and getting them back. And the Fed lowered rates after the housing crash, allowing some to save their homes. Yet many wealthy owners did walk away from their mortgages.