Money theory is mostly a fraud to convince people that regular folks should not accumulate too much money. The economists all fear money velocity. They are likely very well meaning and are textbook sound, but certainly they do unknowingly help advance what I believe to be a scam. The following statement by Will Rogers is worth more than all the economists put into a basket as to its veracity about the ridiculousness of fearing a little money velocity:

This election was lost four and six years ago, not this year. They [Republicans] didn’t start thinking of the old common fellow till just as they started out on the election tour. The money was all appropriated for the top in the hopes that it would trickle down to the needy. Mr. Hoover was an engineer. He knew that water trickles down. Put it uphill and let it go and it will reach the driest little spot. But he didn’t know that money trickled up. Give it to the people at the bottom and the people at the top will have it before night, anyhow. But it will at least have passed through the poor fellows hands. They saved the big banks, but the little ones went up the flue. Nov 27, 1932

|

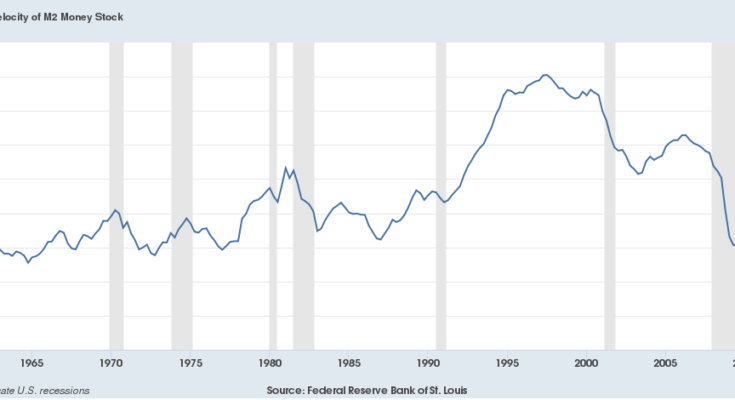

| Velocity of Money |

Traditional money theory posits that the velocity of money increases if interest rates rise. This view is held almost universally, and certainly is held by Talkmarkets contributor Michael Ashton and Market Monetarist Scott Sumner.Â

Michael Ashton says this about it:

M2 money growth accelerated throughout 2016 as the economy improved, and ended the year at 7.6% y/y. Interest rates are rising, which will help push money velocity higher. It’s hard to see how that turns into a disinflationary outcome.

And Scott Sumner says this:

Economics is full of obvious truths that sound odd when expressed in an unfamiliar way. Everyone knows that the real demand for money slopes downward, as a function of the nominal interest rates.  It’s in all the textbooks.  If you raise the opportunity cost of holding base money (the interest rate) people will hold less base money.  It’s basic supply and demand.