On June 13th and 14th the Federal Reserve will meet and by all accounts will raise the Fed funds rate by another 25bps as part of its strategy to “normalize†rates. Central banks want to wind down the extraordinary monetary stimulus employed to deal with the financial crisis of 2008. The Fed is trying to fulfill its dual mandate of price stability and full employment. It believes that it is nearer to those goals than at any time in the past five years. The question is whether this stimulus should be withdrawn now given that:

- The annual inflation rate has run well below the 2% target for virtually the entire period since the financial crisis; the Fed has consistently overestimated the anticipated inflation rate each and every year;

- While the unemployment rate has fallen to 4.3%, this low rate has not had any impact on wage growth; wage increases have been consistently at the 2.5% annual rate; and

- The economy continues to operate at less than 80% capacity; it does have room to expand without contributing to inflation.

A recent article in the Financial Times, puts the issue this way:

Having created expectations that it was likely to tighten policy over the course of 2017, the Fed is acting more like a party to a contract that feels the need to honour its terms, than a central bank that takes the data as it finds them[1] .

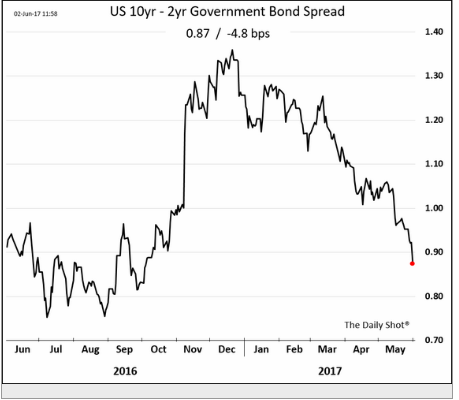

Figure 1 Yield Curve Flattens

In fact, the bond market takes the†data as it finds themâ€. The yield curve flattened considerably over the last couple months (Figure 1) as long rates have declined sharply. The 10yr-2yr Treasury bond spread has returned to levels existing in the fall of 2016. At that time there were concerns regarding deflation and stagnant growth. The fall in long term rates suggests that any further tightening introduces the prospect of a recession in the near term. It certainly does not suggest that the economy is flourishing; that the business and consumers could withstand further rate increases; and that the economy could expand faster than its current sluggish pace.