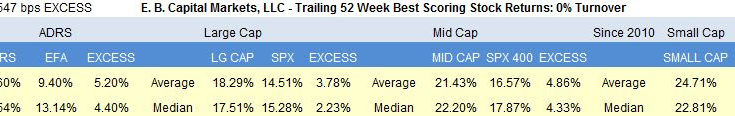

Top scoring weekly returns:Â Buy and Hold 1 Year

The four most dangerous words in investing are: ‘this time it’s different.” – Sir John Templeton

Utilities remain at the top of our weekly sector ranking. The only other sector to score above average this week is basic materials.

Â

Industrial goods and consumer goods score in line. Large and small cap industrial goods are better than mid cap.

Â

Healthcare, financials, services, and technology all score below average. In healthcare, tilt to large and mid cap, rather than small cap.

The following chart visualizes score by sector and market cap.

The next chart displays the four, eight, and 12 week moving average of our weekly scores since 2010. Historically, risk reward is positive when the blue line is higher than the green and red line.

Utilities

The following chart helps to put utilities performance this year in context. It compares the monthly return of the XLU against the Nasdaq 100 and shows the de-risking that has been occurring in equity markets in 2014.

Let’s look at that in relation to how the two have behaved historically. In the next chart, I break out the average monthly returns for both the XLU and QQQ. The XLU typically takes an every-other-month approach to outpacing the QQQ into summer, with the XLU historically outperforming the QQQ in April, June, and August. That said, this chart also suggests that defensive baskets advantage from April through June is not extraordinary. If it isn’t, than managers will want to be putting risk back on in the third quarter.

Basic Materials

Independent oil & gas is typically much stronger in the first half of the year than the second half. The following chart breaks out historical monthly average returns for the S&P OIl & Gas Exploration & Production ETF (XOP). Over the past decade, managers have been wise to reduce weights in May.

Top Scoring by Market Cap/Universe