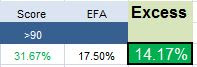

The top scoring ADRs from 1 year ago (4/8/2013) produced an average  1,417 bps of excess to the EAFE in the past year, with 0% turnover. The best performers have been TRIB up 50%, ICLR up 47%, and AZN up 33%.

- Utilities are the top scoring sector across ADR’s.

The following chart shows historical seasonality for the utilities (XLU)Â industry and reflects average excess/underperformance relative to the EFAÂ by month.Â

The average ADR score is 42.48, below the four week moving average score of 45.91. The average ADR is trading -17.68% below its 52 week high, 1.13% above its 200 dma, has 3.65 days to cover held short, and is expected to grow EPS by 25% next year.

Â