Fortunately we had Cycles within our arsenal to better prepare for what was a false “impulse†move. Within the weekend report, I wrote, “The drama in the Ukraine has implication for the supply of Crude, so a short term risk premium is likely to be added to price. Based on where the Cycle stands today, a break lower should be coming, but I have suspicions that we might see a few more days higher before that happens.â€

So we did see a rather substantial spike because of this news, at one point crude was up a full $2 from its Friday’s close. Although the spike would have occurred (regardless), even if crude was already in decline, we were right to wait for clear signs the Cycle was headed towards a DCL. The spike “suckered†many of the speculative long positions because they were watching the bullish up trending chart. Unaware of the overdue Cycle they push their luck one time too many. Again, quoting the weekend report, “Crude’s Daily Cycle is aging, so a turn lower is becoming more likely. This is where Cycle analysis often trumps traditional charting – Cycles can predict turns not yet visible in normal technical analysis.â€

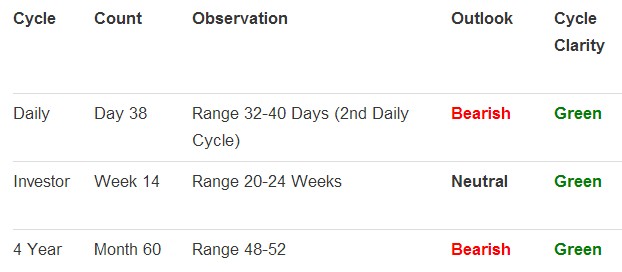

And with Tuesday’s massive reversal, the bottom simply fell out of the crude market today. Clearly, there is no doubt that a DCL move is now well underway. The only question from here is, just how deep and for how long this decline will persist. The sheer size of the Daily Cycle rally foretells of a deep sell-off. But then the dollar’s ICL fall is imminent, and it should be substantial enough to cushion crude’s fall. Cycles are excellent at predicting turns (time) where they seemingly do not appear likely. But they do not necessarily do as well predicting the actual price of these turns. Â

This is a special report from this week’s premium update from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly. Promo code ZEN saves you 10%.