Greetings,

Let’s begin by taking a look at a few developments in emerging markets.

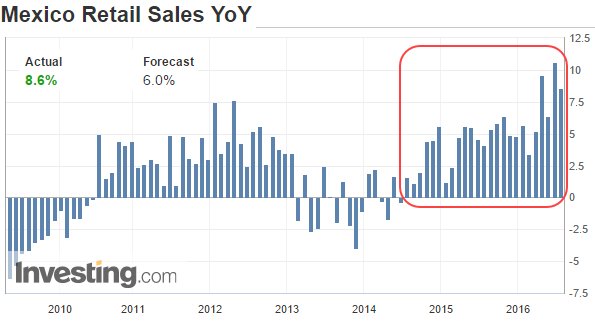

1. Growth in Mexico’s retail sales has been solid, consistently beating expectations.

2.. We know that a portion of these improvements in Mexico’s retail sales has been driven by remittances (due to stronger US dollar). Is the nation’s credit expansion also responsible for increased spending?

Source: â€@CapEconEmerging

3. Â Brazil’s consumer confidence rose more than expected. Green shoots?

3. The Nigerian naira continues to weaken (hitting another record low) as the country’s FX reserves dwindle. The chart below shows one dollar buying a larger amount of naira.

Source: tradingview.com

4 Here is a scatter plot showing sovereign CDS spreads vs. government bond ratings. NGN stands for Nigerian naira.

Source:Â Credit Suisse

5. The Russian ruble weakens for 5 days in a row on falling oil prices (chart shows # of rubles one dollar buys).

Source: barchart.com

6. According to Goldman, Russian oil production will accelerate sharply in the next couple of years. It will be interesting to see how the Saudis will react to this.

Source: â€@vexmark, @business

5. Indian shares continue to rally, approaching a one-year high.

Source: â€Ycharts.com

6. Turkish shares bounce back.

Â

7. Poland’s unemployment rate hits the lowest level since 2008.Â

8. As China devalues the RMB not just against the dollar but against the currency basket (which the yuan is supposed to track), other nations start paying attention. Will this trigger “competitive devaluation” (otherwise known as “currency wars”)?

Source:Â WSJ

9. China’s stock market volatility has fallen dramatically as speculators move to greener pastures (such as cotton futures, Macau, etc.).

Source: â€@markets

10. Emerging markets sentiment recovers with commodities.

Source:  â€@Callum_Thomas, ASR

11. The Merrill Lynch investor survey shows alocators gradually moving back into emerging markets.

Source:Â BofAMLÂ

1. Switching to Japan, the yen is gaining sharply this morning on renewed uncertainty. Markets are concerned that the BoJ may disappoint.