Greetings,

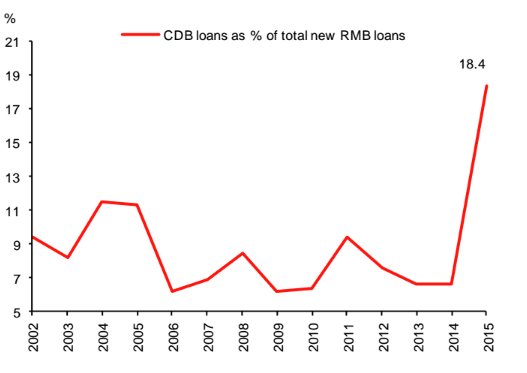

We begin with China where a part of the fiscal stimulus has been orchestrated via the state-controlled China Development Bank (CDB). The bank is known for financing large infrastructure projects.

Source: Macquarie

As discussed yesterday, China’s recent growth has been fueled by credit. With increased liquidity (injected via stimulus – for example above) and low interest rates the demand for wealth management products (WMPs) has risen sharply, which in turn created demand for corporate debt. The chart below shows financing for WMPs by banks (banks providing liquidity to the “shadow banking” system).

Source: Nomur

The rising debt and leverage levels are making the authorities nervous. Nomura expects the current credit-fueled China growth burst to be short-lived as regulators’ concerns should cap credit expansion.

Source: Nomura

This next item is quite important for policy considerations both in China and in the US. As discussed before, a further dollar rally is likely to result in rapidly tightening financial conditions. Here is one of the key reasons investors should be very concerned about a significantly stronger US dollar.

Source:Â Macquarie

Let’s continue with emerging markets.

1.  Polish debt could be downgraded shortly by Moody’s due to some populist government policies. Debt spreads continue to widen.

Source: @fastFT

Back in December, the Polish government removed a tax on government bonds held by banks in order to finance its rising deficit (taxes are generally levied on bank assets, but the government bond holdings became exempt). It worked. This is what happened to government bond holdings at banks. That’s why the spread widening hasn’t been as severe as it could have been.

Source: HSBC

2. It’s hard to see how Venezuela can make it through 2016 without a default. Most of the government revenue comes from energy.