Greetings,

We begin with several economic trends in the United States.

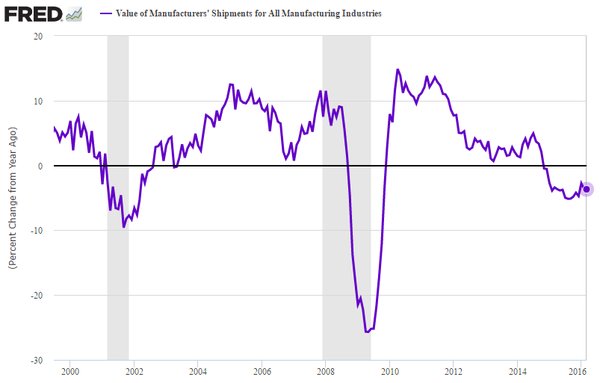

1. US manufacturing shipments continue to decline (YoY).Â

2. As discussed before, the manufacturing sector is shedding jobs again. Also, the overall private payrolls from ADP came in below expectations.

Source: ADP

3. Small businesses are once again driving US private payrolls growth.

Source: ADP

4. This Friday we should see how the labor markets performed last month. For now here is SocGen’s comment on the US labor force growth.

Source: SocGen

SocGen sees the number of entries into the “not in the labor force” series slowing sharply.

Source: SocGen

5. Next, we have a comment from the Dallas Fed on slow US wage growth.

Source:Â DallasFed

Source:Â DallasFed

6. Below are the drivers of US labor costs, as the healthcare inflation rises again.

Source:Â @BLS_gov

7. According to Goldman, US corporate margins are declining because labor cost increases outpace inflation.

Source:Â Goldman Sachs

8. US productivity remains stalled.

9. Investment in drilling and O&G exploration has collapsed. Investments related to other commodities such as agriculture have declined as well.

Source:Â HSBC

However, US private investment outside of commodity-linked sectors continues to grow.

Source:Â HSBC

10. US trade deficit falls to the lowest level in 13 months .

North of the border, Canada’s trade deficit hits a new record. This trend is related to low energy prices which decreased the value of exports. Another driver is the relatively weak Canadian dollar which made imports more expensive.

Source:Â HSBC

Turning to China, the nation’s debt-to-GDP ratio is climbing rapidly. Here is the breakdown by the type of debt.

Source: Goldman Sachs, Business Insider

Many China watchers point out that the GDP growth has become highly dependent on credit growth.Â