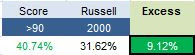

The best scoring small caps from one year ago (1/24/2013) have outperformed the R2K by 912 bps over the past year, with no turnover. Â The best performers have been RAD up 282%, MDSO up 167%, JAZZ up 161%, and AFFX up 134%.

Methodology

Our weekly best and worst reports show you stocks with the best potential returns over the coming 6 to 12 months. The score is calculated by fusing together the key drivers of price movement including, earnings beats, earnings growth, at-the-market insider buys, institutional activity, short ratio analysis, price to earnings analysis and calendar quarter seasonality. Those stocks appearing in our best list should be bought while those appearing in our worst list should be sold.

NOTE:Â Universe composition has been updated by market cap

Â

- The best small cap sector is industrial goods.

The average small cap score is 61.61, above the 4 week moving average score of 60.96. The average small cap is trading -17.29% off its 52 week high, 8.8% above its 200 dma, has 7.05 days to cover short, and is expected to grow earnings 37% next year.

Â

The best scoring small cap sector is industrial goods.  Healthcare also scores above average. Services and consumer goods score in line. Financials, technology, utilities, and basics score below average.

Â