As has been the case since we began this series, the markets reversed at the price targets we had identified in last week’s article. Below is a brief recap of last week’s price projections, and the price targets for next week.

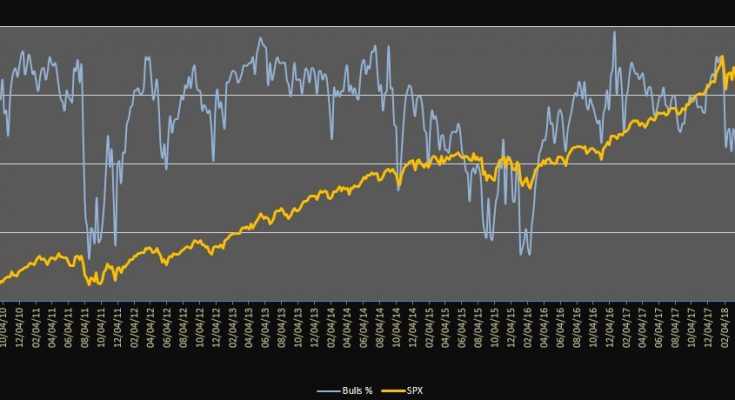

Weekly sentiment continues to hover around the 50% level, reflecting the lack of conviction among bulls and bears:

The SPX tested our downside projection on Tuesday, bounced back sharply and finished the week within the well-defined narrow range of 2700 – 2740. Last week we also referenced the CIT Pivots, and the chart below shows the level of precision which they can provide. They work well with CIT Cloud and CIT bars which are helpful for identifying trend changes, and for trade management:

The projected price range for next week for the SPX is 2675 – 2785.

You can keep track of our daily and intraday market updates here.

All forex pairs reached our upside or downside targets, but a special mention goes to USDCHF which tested both our upside and downside targets on Tuesday and finished the week in the middle of the range.

Timely CIT (change in trend) signals are provided by the CIT SAR (top pannel) and the CIT Swing Time (bottom pannel) indicators.

The projected trading range for next week for USDCHF is 0.978 – 1.00:

The Euro broke below our downside target on Tuesday but pulled back within the range on the very next day, and traded for the rest of the week in the middle of the trading range.

The projected trading range for next week for EURUSD is 1.155 – 1.18:

The Pound’s slide stopped and reversed at our 1.32 downside target.

The projected trading range for next week for GBPUSD is 1.315 – 1.35:

USDJPY tested our downside target of 108.7 all week long, but never managed to break below it.

The projected trading range for next week for USDJPY is 108 – 110.15:

The USDCAD started the week by climbing to within a few pips of our upside target, then reversed and tested the downside target, and finished the week in the middle of the trading range.