Sometimes having access to torrents of information can be a blessing in addition to a curse. Berkshire Hathaway has is watched so closely that the noise too often drowns the reality. Last quarter I began reviewing Berkshire Hathaway’s earnings reports, both for insights into the company that it gives as well as the glimpses received of the overall economic environment. This past Friday, November 4th, Berkshire reported its third quarter earnings for the year. After reviewing the quarter’s performance, valuation assumptions will be updated for both the Class A and Class B shares.

The information presented will generally include a comparison of Q3 results, first nine month results, and full year 2015 results to gauge trends and be organized by the divisions typically laid out in the Annual Report.

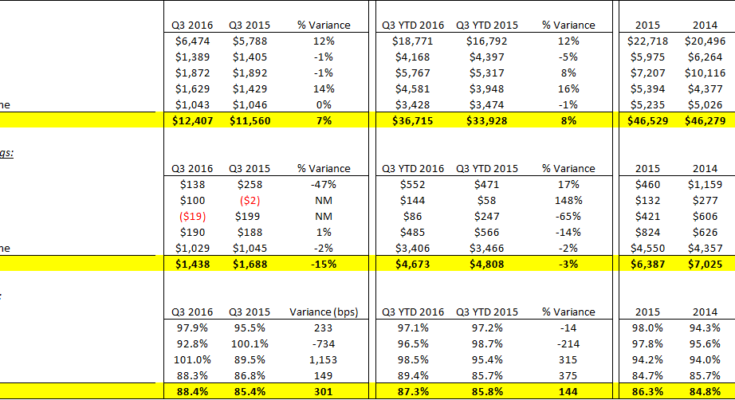

Insurance

Source: Berkshire Hathaway SEC Filings

Insurance underwriting results were mixed, with strength in the primary lines and mediocrity in reinsurance, likely a reaction to ongoing pricing trends. Reinsurance premiums were close to flat versus double digit increases at both GEICO and the other primary lines.

Ajit Jain took responsibility for Gen Re this past May and placed Kara Raiguel in charge following the retirement of Tad Montross, so it’s a source of interest to follow the financials of the division to see how they evolve. In August it was reported that Jain outlined several areas in which he felt Gen Re could improve. Among them was a reduction in management layers to reduce costs as well as a change in the incentive system which was previously designed to reward margins rather than overall profitability. By most accounts Tad Montross ran Gen Re successfully and the company recovered extraordinarily well from the problems that beset it at the time of Berkshire’s acquisition in 1998. There are times, though, when one gets the sense that the scars from that time left its mark on the division and that there are instances in which it has become too risk-averse. Premium trends have improved as the year has progressed, with a 1% decline in Q3 versus a 7% decline in Q2 and a 5% decline year-to-date. More impressively, profitability has dramatically increased with about $.07 in underwriting income in the third quarter this year versus break-even results in the preceding year.

GEICO’s business continues to expand. Although approximate, it is probably now writing about 12% of all auto insurance premiums in the United States. Profitability has been challenged somewhat compared to its historical record in recent years. Pricing was increased last year in order to react to increased losses and in the quarter an increase in policies was responsible for 5% growth in premiums and pricing for the remaining 7%. Despite the higher pricing, both claims expenses and operating expenses increased from the previous year as a percent of earned premiums. In the case of claims, the number of claims did not rise disproportionate to premiums, meaning the average severity was to blame for the increased claims ratio. The rise in expenses might be a prelude to a very good fourth quarter as it seems they were a reaction to a sharp increase in the need to service new policies.