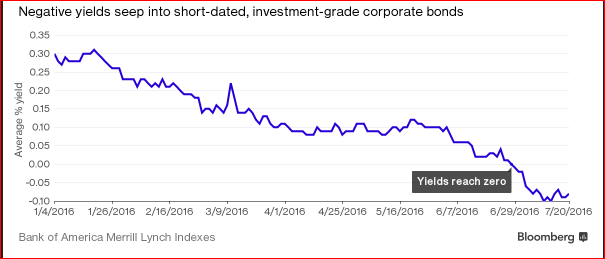

History was made last week when Henkel, the German maker of household detergents and Sanofi, the French drug maker became first non-financial public companies to sell euro-dominated bonds at negative yields. The two combined to raise 1.5 billion Euros at a rate of minus 0.05 percent . Negative yields are commonplace in the EU sovereign debt markets. Now that investment grade debt has entered this segment of the credit markets, the once unthinkable is a feature of the corporate bond world. As Figure 1 shows the move from positive to negative yields in corporates was relatively swift and uninterrupted this year.

Figure 1 Negative Yields in Investment Grade Bonds

According to estimates by BAML, investors are holding about 465 billion Euros ($512 billion) of investment-grade company bonds with yields below zero or 24 percent of the total investment grade market. This represents  an eleven-fold increase on the start of the year. The highest-rated euro-denominated senior and secured debt of non-bank companies maturing in one to three years yields an average of minus 0.08 percent, the BAML data shows. This development  is not totally confined to the European market. The CIBC, one of the top five Canadian banks, recently raised $1.8 billion covered bonds with a negative yield in the Euro bond market. No doubt the CIBC’s success will likely encourage other financial institutions in North America to tap this market. This does not appear to be just a passing fad.

It is noteworthy that, initially, financial companies were able to take advantage of this market ( Figure 2).

Figure 2

|

Selected Negative Yielding Capital Structures, |

|||

|

Corporation |

Investment Rating |

Country of Risk |

|

|

BMW Finance |

A |

Germany |

|

|

Daimler Fin |

|

A- |

Germany |

|

GE Capital Eur. |

AA_ |

US |

|

|

Shell Int`l Fin |

AA- |

Netherlands |

|

|

BNP Paribas SA |

A+ |

France |

|

|

Siemens Fin.NV |

A+ |

Germany |

|

|

Source: Goldman Sachs |

| ||