Government Properties Income Trust (GOV) is a high yielding real estate investment trust or REIT. The business model is simple. The company leases offices to federal, state and other government institutions (where it derives about two-third of income) and private enterprises (where the remaining one-third of rental income comes in).

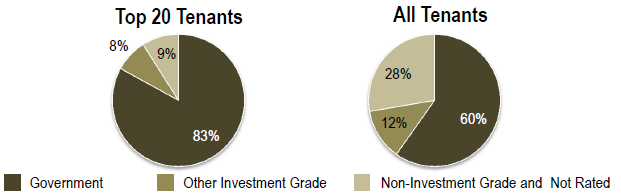

GOV’s total portfolio, factoring in known acquisitions includes 18 million square-feet across 170 buildings, with 54.3% of the portfolio located in the Metropolitan Washington DC market. The portfolio has a blended occupancy of 94.1% with a weighted average lease maturity of 4.9 years. It is a well-established business with high-quality tenants.

Source: Company presentation

The question is, can you consider buying here? We believe that you should use caution in the name as the company is losing money and funds from operations are barely covering the dividend. However, we think shares are at levels that could be promising for a speculative buy.

Q4 review-dividend barely covered

The company is losing money. Net loss available for common shareholders on a GAAP basis, was $18.3 million, or $0.18 per diluted share, for the quarter ended December 31, 2017, compared to net income available for common shareholders of $12.1 million, or $0.17 per diluted share, for the quarter ended December 31, 2016.

Net loss available for common shareholders for the quarter ended December 31, 2017 includes a $9.3 million, or $0.09 per diluted share, loss on impairment of real estate. The weighted average number of diluted common shares outstanding was 99.0 million for the quarter ended December 31, 2017 and 71.1 million for the quarter ended December 31, 2016. While this hurts, we should look to the funds from operations to check dividend coverage.

Normalized funds from operations, or Normalized FFO, available for common shareholders for the quarter ended December 31, 2017 were $49.2 million, or $0.50 per diluted share, compared to Normalized FFO available for common shareholders for the quarter ended December 31, 2016 of $41.5 million, or $0.58 per diluted share.  This decline is a big risk factor. The biggest issue? The dividend of $0.43 is getting dangerously close to not being covered by funds from operations. This is true for the annual results as well.