When looking at the Top 15 in the Monthly Ranking and Rating list we can see that for the coming month the following stronger currencies are well represented for going long: JPY(7X) followed by the NZD(3X). The weaker currencies are the GBP(7X) followed by the EUR(3X) and the CAD(2X).

A nice combination for coming month may be e.g:

- GBP/JPY with the EUR/NZD

- GBP/NZD with the EUR/JPY

- GBP/JPY with the NZD/CAD

- GBP/NZD with the CAD/JPY

These are just a few examples and many other combinations are possible. The mentioned pair combinations can be traded at the same time according to the rules of the FxTaTrader strategy because these are all different currencies. Generally speaking, by not trading the same currency in the same direction more than once in the same Time Frame you may have better chances with lower risk. In any case it seems always better to spread risk and this can be done in many different ways.

When trading with more than 2 micro lots it is a good idea to have a diversification and depending on your bias it may offer opportunities by going long or short on a specific currency trading it against different other currencies.

______________________________________

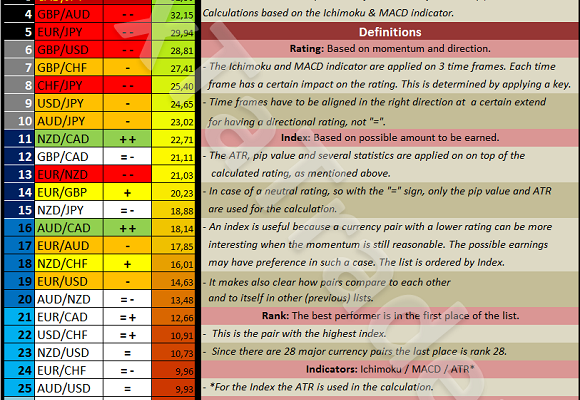

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every month the Forex ranking rating list will be prepared as the months change. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

______________________________________

For analyzing the best pairs to trade looking from a longer term perspective the last 12 months currency classification can be used in support.

This was updated on 31 July 2016 and is provided here for reference purposes:Â

Strong: USD / JPY. The preferred range is from 7 to 8.

Average:Â CHF, NZD. The preferred range is from 5 to 6.

Weak: EUR, GBP, AUD, CAD. The preferred range is from 1 to 4.

When comparing the 12 months Currency Classification with the pairs mentioned in the Ranking List above some would then become less interesting. On the other hand these pairs are at the top of the list partly also because of their volatility. It seems best to take positions for a shorter term then and take advantage of the high price movements.