Friday, another “meh” moment for the U.S. economy. The June Markit PMI manufacturing composite declined to 52.1, its weakest reading in 9-months.

The service sector index also declined to 53.0, below economists’ expectations of 53.7. With both sectors in decline, the net-composite output index fell to a 3-month low.

Where do we go from here?

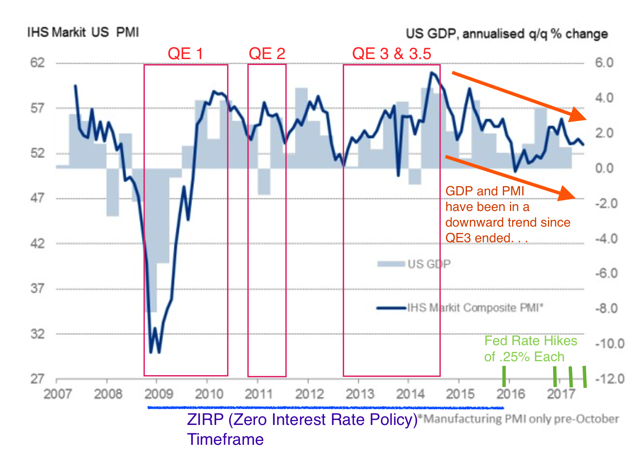

There is an interesting correlation between the IHS Market PMI Composite and the United States GDP. . .

A weakening Markit PMI isn’t a good sign for GDP. And when you look closely at the economy’s past growth, paired with and without the Fed’s accommodations, it is worrisome for what lays ahead.

Â

Although anemic, the U.S. had upwards trending growth since 2009 to mid-2014. But since ending QE-3, the economy is trending weaker. . .

A strong dollar hasn’t helped the economy boom either.

Â

What’s striking is that the last three times GDP and the PMI was this low, the Fed actually upped their accommodations.

But Janet Yellen is clearly not “Helicopter Ben”, the nickname given to Former Fed Chairman Ben Bernanke for his easy money policies. Instead of easing, she is tightening. Not only has she hiked rates four times, but last week she laid out plans for her “Quantitative Tightening.” This is reversing the $4.5 trillion in bond purchases on the Fed’s balance sheet, and now dumping them into an already weak economy.

But I think this is all wishful thinking by the Fed. . .

I wrote last week that the bond market isn’t buying the Fed’s optimism either. The lack of confidence is pushing longer-term yields down because the bond market is predicting deflation and recession. All while the Fed is busy raising short term yields aggressively.

This is flattening the curve yield, and I believe soon it will invert.

The Fed is tightening in a time where the data isn’t looking good. If they even can get rates up to their targeted 3%, they’ll have to cut them immediately soon after because of a recession and deflation.