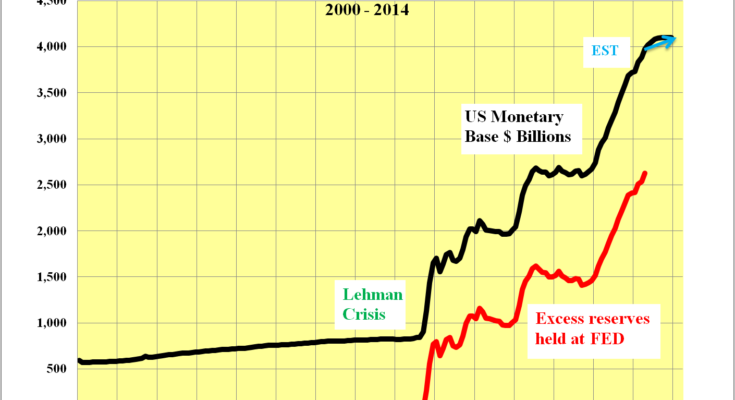

The U.S. monetary base has increased 400% in less than 6 years, from $0.8 trillion in 2008 to almost $4 trillion today. Meanwhile commercial banks have, for the first time, built up huge surplus reserves of $2.6 trillion at the FED. Monetary policy has traditionally been transmitted into the economy through the banks by lending the newly created money to corporations and individuals. The rise in the excess reserves at the FED indicates that this taking a lot longer than it has in the past.

Subtracting the $2.6 trillion excess reserves from the total monetary base leaves only $1.35 trillion that is actually working, a mere 70% more than in 2008. This could well explain the moderate pace of economic recovery, the lack of inflation, and the continuation of low long-term rates. There seems to be a chronic lack of demand for the newly created money, which would explain the build up of the excess reserves as the money has nowhere else to go.

Theory has it that rising money supply should lead to economic recovery, rising inflation and interest rates, as well as a rise in the price of gold and other hard assets. Yet while the expansion of the total monetary base has been unprecedented, none of the aforementioned has increased anywhere close to the same magnitude. The increases that have taken place seem much more in line with the moderate increase in the actual working monetary base.

U.S. corporate balance sheets are flush with cash, recently estimated at $2 trillion. This reduces their need to borrow to meet capital expenditures. It also puts corporations in the position of being able to either raise dividends or buy back shares or acquire other assets in the market place.

On the supply side of the equation, the excess bank reserves at the FED points to there being more than enough money to lend. However, with corporate needs reduced, demand is suppressed.Â

Demands from individuals for loans and mortgages are also curtailed. This is partially because of moderately higher mortgage rates but also because of much more restrictive banking regulations. The banks are risk averse and so are not making money available to individuals. Proof positive of this is the closure of entire bank mortgage departments.