If we are to believe reports regarding stocks and the housing market, the Fed could be in a box. It could destroy stocks, or destroy the housing market depending on which way interest rates go.

The recovery in stocks has been driven by financials. The reflation/inflation trade was all the rage when Donald Trump took office. But it is starting to look like this was just another bond tantrum that kind of came and went. Lots of people staked their reputations on this inflation trade.

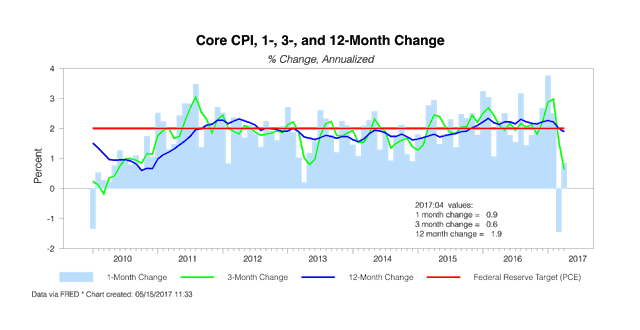

JP Morgan has warned that a decline in rates could severely impact the stock market. It wants some inflation at this late date. But the Fed is not cooperating, as Tim Duy has said that inflation and unemployment are too low and are preventing the Fed from reaching its goals.

|

|

Tim Duy by Permission  |

And it looks like we are seeing some problems on the demand side. Retail is hurting and so is the food industry. According to Peter Schiff, online buying is not offsetting the retail/food service slide.

A fundamental weakness appears to be forming. Capital is winning and labor is losing. Demand is withering. We have the added pressure of oil inflation as a possibility and housing inflation.

So, the Fed could still be looking to raise interest rates by 75 basis points, which could severely hurt housing, while giving financials a boost. The only way that the Fed could raise rates and continue housing demand would be to come up with down payment assistance on a very wide scale and loosen credit restrictions. That has not worked out so well in the past. But easy money 3 percent loans are being launched by Bank of America.Â

I have mentioned before that interest rates are not a leading indicator, but it depends on what you are trying to watch. If it is GDP, interest rates have proven to not be a leading indicator. If it is financial stocks and housing, it appears that interest rates could be a leading indicator of potential demand for either sector.