I have to confess that the latest stock rally has caught me by surprise, particularly its magnitude as the Dow looks set to soon challenge the 20,000 level. Meanwhile, as many observers are quick to point out, by many measures the valuation of equities in the United States is starting to look extremely stretched.

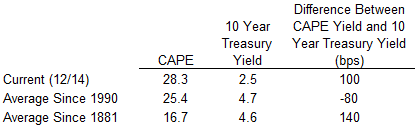

Saying that the cyclically adjusted price to earnings ratio (CAPE) is at an historic high feels like nothing more than beating a dead horse at this point. Everyone knows it and everyone also knows that the current CAPE has only been exceeded in 1929, 2000, and 2007. Quite a few observers interpret that as a sign that the market is expensive and ready for a correction. Others point out that the US equities market is not all that overvalued when compared to more recent history and even cheap when compared to interest rates.

Source

I tend to side with the former and believe the general market has gotten expensive at current valuations and a recession induced profit decline or higher long term rates could pose serious problems in the near future.

Regardless of your personal viewpoint, it is hard to make an argument that international equities markets are, on the whole, trading more cheaply than the United States. Consider that Italian stock market. The comparable CAPE in Italy is about 12x at the moment – a 57% discount to the United States. Italy, along with the rest of Europe, has enormous challenges ahead of it. But in a world where large corporations have exposure to the global economy, does this sort of a discount really make sense? I don’t think it does and I recommend Exor as a means of taking advantage of cheaper valuations internationally.

Exor (EXOSF) is a holding company for the Agnelli family, whose patriarch founded Fiat (FCAU), and run by John Elkann. The company trades at a meaningful discount to its net asset value, has a net asset value that is made of various companies that are arguably undervalued themselves, and has a track record of terrific management. Further, in the most recent stock market rally many of the components of Exor have seen strong performance while Exor itself has not rallied to such an extent. With the stock trading at around $43 per share, net asset value is probably about $58 per share today.