Annaly Capital Management (NLY) is down significantly from its highs over the summer. However, the stock remains a value trap. The mortgage REIT is facing secular headwinds in early 2018 as Treasury yields move materially higher. Mortgage REITs are primarily valued based on price-to-book. The problem for most retail investors is that the last published book value isn’t the same as the current book value.

Declining Book Value

Given the rapid increase in Treasury yields and the corresponding decline in bond prices, most mortgage REITs are already sporting large unrealized losses in their portfolio as of February 19, 2018. The damage comes from two sources. One is that a large movement higher in rates leads to a significant decline in book value. The second is a widening of the spreads between RMBS (residential mortgage-backed securities) and their corresponding hedge portfolio.

The damage from the widening of spreads isn’t a major problem. Those spreads will gradually widen and shrink over time. However, the significant increase in rates is a major problem. The book value lost due to the rapid change in rates represents a fundamental problem for residential mREITs in a period of rising rates.

The dividend level a mortgage REIT can support is a function of their yield on assets, the net interest spread, their operating expenses, and the amount of book value available for leverage. When the book value declines, all of these other yield metrics are multiplied by a smaller equity base. That results in less net interest income per share. Eventually, the decline in net interest income per share leads to a reduction in the dividend.

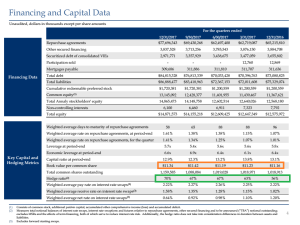

The trend in book value was previously flat, as shown in this slide from their Q4 2017 supplemental:

The orange box demonstrates the book value per common share. Investors should expect that to be down quite a bit since the end of the Q4 2017.

The green box highlights the hedge ratio. This is important because it is going to be relevant to the company’s cost of funds as the hikes in interest rates continues.