US equity futures and Asian stocks were unchanged while European stocks declined after touching the highest level in almost a year, as Italian and Spanish banks dragged indexes lower. The dollar eased back from 14-year highs as bond yields fell on Wednesday and oil extended its advance in increasingly thin trading.

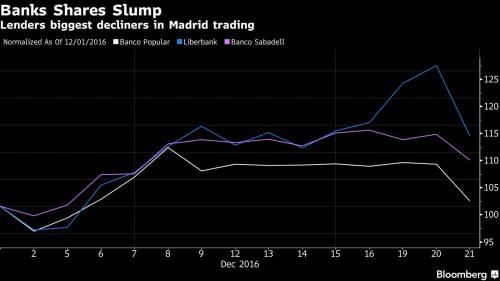

Spanish banks fell after a ruling in the European Union’s top court that may result in them handing back billions of euros to mortgage customers. Bank shares tumbled by as much as 10%. Borrowers who paid too much interest on home loans pre-dating a May 2013 Spanish ruling on so-called mortgage floors are entitled to a refund from their banks, judges at the EU Court of Justice ruled in Luxembourg Wednesday.

As after a ruling , the court said that a proposed time limit on the refunds is illegal and customers shouldn’t be bound by such unfair terms. Banco Sabadell SA fell as much as 7.5 percent, while Banco Popular slipped as much as 10.5%, the largest decliner in Spain’s Ibex 35 benchmark.

“This comes as a surprise and in a bad moment for Spanish banks as most of them would have to make extra provisions to pay for this,†Daragh Quinn, an analyst at Keefe Bruyette & Woods, said by phone. “It will mean pressure on capital generation and profits in the fourth quarter.”

Meanwhile in Italy, Banca Monte dei Paschi di Siena SpA fell on concern it may fail in its efforts to raise €5 billion euros of funds and after it said its liquidity may turn negative in four months. Oil traded above $53.50 a barrel as data showed U.S. stockpiles declined last week. The yen strengthened and the dollar slid from the highest since 2003 versus the euro.

Looking at Bloomberg data, volumes are thinning and swings in global equities are muted, with European equity volatility dropping to the lowest since 2014. The Trumflation rally has proppelled the Dow Jones to all time highs just shy of 20,000 on prospects for increased government spending in the U.S. and while Ray Dalio offered praise for Trump’s policies, Mohamed El-Erian and his former colleagues at Pacific Investment Management Co. say now’s a good time to take advantage of the latest rallies in global financial markets and scale back from risk.

“It makes total sense to take some money off the table,†El-Erian, the chief economic adviser at Allianz SE said Tuesday. “We’ve priced in no policy mistakes. We’ve priced in no market accidents, and we’ve ignored all sorts of political issues,†he said on Bloomberg TV. In October, El-Erian said that he held about 30 percent of his own money in cash.

The MSCI index of Asia-Pacific shares ex-Japan inched up 0.1% after a string of losses. Tokyo’s Nikkei share average fell, pulling back from earlier one-year highs to close down 0.3 percent.

In Europe, the Stoxx Europe 600 Index fell 0.1 percent in early trading. The gauge closed at its highest level since December 2015 on Tuesday. European banks led declines, falling 0.5%. Futures on the S&P 500 Index were little changed The gauge rose 0.3 percent to 2,266.5 on Tuesday, a point below its all-time high. The Dow Jones Industrial Average closed at record 19,974.62.