When managing a portfolio of closed-end funds (CEFs), often times the valuation of funds you do own are less important to consistently evaluate than the funds you don’t own. This is a key reason why every CEF investor should maintain a watch list of familiar funds on their radar screen.Â

Evaluating closed-end funds is a much different exercise than more traditional ETFs, where nearly every move is relatively correlated with the daily fluctuations of the underlying index. In CEFs you can actually view dislocations happen in real-time, since there is no guarantee of any meaningful correlation with fixed-income or equity prices.

In the ETF universe I have found that investors will consistently be drawn to buying the newest fund launches or smart beta strategies, while shunning old or boring strategies. With CEFs, you have to consistently evaluate a fund’s potential and often times the best opportunities can arise from funds you once thought were no longer of value at a previous point in the past.

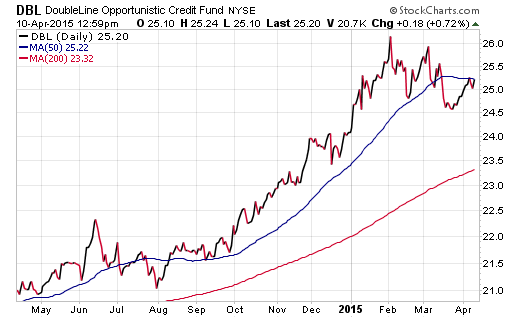

This exact scenario happened last week at our firm, when I was evaluating and updating our watch list. I uncovered a small dislocation in a fund that we actually sold in late May of 2013. The DoubleLine Opportunistic Credit Fund (DBL) was a holding within our Dynamic CEF Income Portfolio that we originally jettisoned because the premium had stretched egregiously past its trailing twelve month average.

More recently, as a result of recent equity market volatility, the market price of DBL slouched from its most recent 2015 high. But in light of recent shifts in the fixed-income markets, the underlying net asset value (NAV) of DBL has risen significantly and even outpaced its peers. The dislocation in the relationship between the DBL’s market price and NAV offered what I believe to be an excellent opportunity to reinitiate exposure for our CEF portfolio.

Â

For those that might not be aware, DBL is one of the few funds in the CEF universe that trades at a consistent premium to its NAV as a result of management star power. In fact, it’s not uncommon for DBL’s premium to reach levels as high as over 10% from its NAV. In addition to being led by Jeffrey Gundlach and his veteran team at Doubleline Capital, the fund has exhibited the consistent ability to create meaningful alpha above its benchmark.