Financial planners advise most clients to defer taking social security payments until either their full retirement age, or even age 70, if they can afford to live comfortably without them.

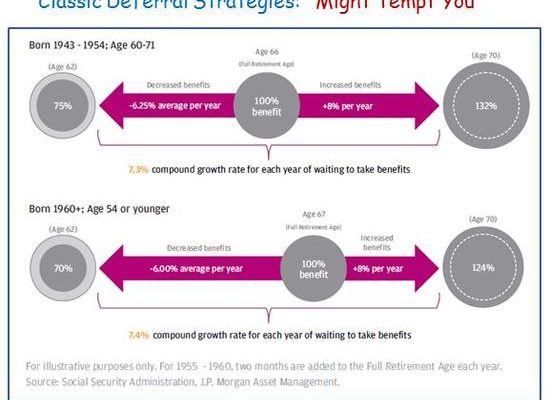

The reasoning sounds simple. Under current law deferring payments might eventually get you substantially more per month. If you live a very long life you could collect more total dollars. Certified financial planners (CFPs) show charts like the one below to illustrate this point.

Boomers (born from 1943 – 1954) are told they will see an extra 7.3% monthly for each year they wait past their normal full retirement age. People born after 1959 would realize an even larger 7.4% increase for each year of deferred gratification.

At first glance that seems like a no-brainer. Who wouldn’t want to collect $4,469 per month versus $1,992? Waiting until age 70 to collect represents a $29,724 difference in annual income.

When you realize what that means for you in the eight years between ages 62 and 70 you might not take the bait. Early retirees would receive $23,904 yearly- $191,232 in total (excluding any cost of living [COLA] adjustments) over the eight years before reaching age 70.

Click on the link below to continue reading Paul’s take on one of the biggest financial decisions you’ll ever make.

You’ve Been Warned

Â

Â