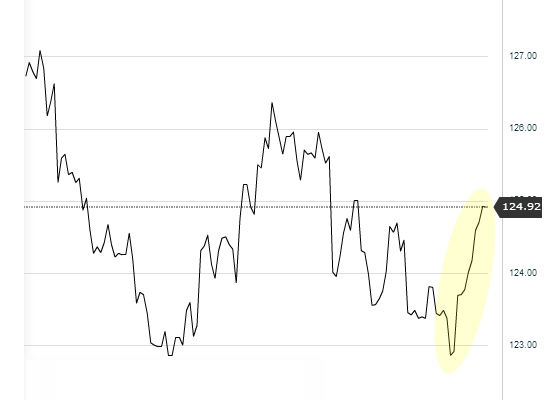

Treasuries rallied sharply last week, mostly on the back of the sell-off in equities as well as in response to the Fed’s seeming backpedaling on the timing of rate hikes.

|

| 10y Treasury Note Futures (source: Investing.com) |

While the equity market pullback makes sense for a number of reasons (including increased leverage and momentum driven activity in a number of shares), the treasury market rally does not. Reading the dovish tea leaves of the FOMC minutes is counterproductive. The Fed’s reluctance (see story) to support its own FOMC members’ projections of higher rates by the middle of next year – which are quite realistic – simply serves to confuse the market. It’s about time the Fed realizes that the US economy can withstand (and in fact could benefit from) higher rates.

Scotiabank: - We think rate hikes next year are a reasonable thing to expect and that the forecast pace is not unreasonable. Indeed, quite frankly, neither do the majority of FOMC officials themselves. Recall that the projections of FOMC officials became more hawkish at the March 19th FOMC meeting when more Fed officials (10 of 16) projected that the Fed funds target would equal 1% or more by the end of next year. This is reflected in chart 2 which is a recreated version of the Fed’s famous dot plot that shows the fed funds target forecasts of individual FOMC officials. Presumably not all 10 of those individuals think that higher rates will commence late in the year and are more spread out in their forecasts, thus making hikes starting in Q2 or Q3 eminently reasonable. More officials also projected a Fed funds target of 2% or greater by the end of 2016 (12 of 16).Â

It can’t be both ways by way of talking down the risk of rate hikes while still forecasting them. Suppressing yields in the short-term only aggravates the potential for disruptive market behavior later. The Fed either has a forecast to which the balance of Fed officials are committed, or it doesn’t. I might not have views identical to those of all of my bright, ambitious colleagues surrounding me, and thus emphasize different risks to a house view. But conducting policy gives each individual one vote and that weighted perspective on Fed views is turning more hawkish, full stop and regardless of attempts by the Fed’s communications subcommittee to massage the market outcome.