Live Feed

* * *

Update:Â Â Why did the dollar and Treasuries react as if stung moments after Yellen’s prepared remarks were released?

Because according to a cursory scan of her speech, she was more hawkish than most expected, arguably making a March rate hike “live” after warning that “as I noted on previous occasions, waiting too long to remove accommodation would be unwise, potentially requiring the FOMC to eventually raise rates rapidly, which could risk disrupting financial markets and pushing the economy into recession.”

Further hawkishness emerged from her claim that “Incoming data suggest that labor market conditions continue to strengthen and inflation is moving up to 2 percent, consistent with the Committee’s expectations. At our upcoming meetings, the Committee will evaluate whether employment and inflation are continuing to evolve in line with these expectations, in which case a further adjustment of the federal funds rate would likely be appropriate.”

Yet to offset that hawkshness, Yellen cautioned that the US economy and fiscal policy face an uncertain path under the administration of Donald Trump, as she played down any expectations of a March rate rise and declared “monetary policy is not on a preset courseâ€. In prepared remarks for her Valentine’s Day testimony Ms Yellen also struck a note of caution about the new administration and expectations that its plans for tax cuts, infrastructure spending would lead to looser fiscal policy and more rapid growth.

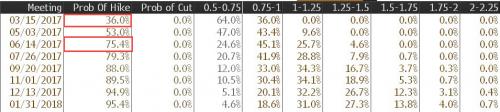

Indeed, looking at the Fed Funds market, March, the increase so far has been some what tepid, with odds increasing from 30% before, to 36% after Yellen’s prepared remarks.

“Considerable uncertainty attends the economic outlook,†she said, pointing to “possible changes in US fiscal and other policies†as one of the main sources of that uncertainty alongside questions about productivity growth and international developments.