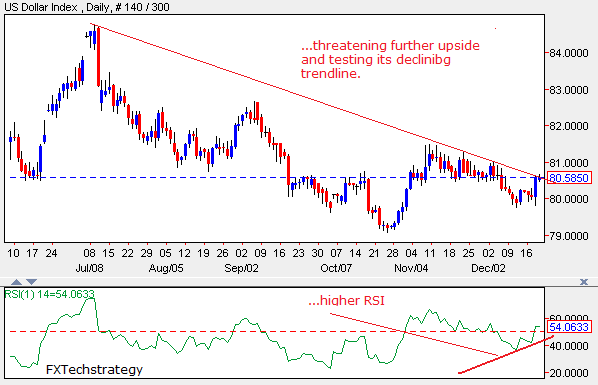

US Dollar Index: With the Index bullish and threatening further upside, more strength is expected.

However, it will have to break and hold above its declining trendline currently at the 80.61 level to trigger further strength. This if seen will extend recovery higher towards the 80.98 level where a violation will aim at the 81.48 level.

A push through this level will set the stage for a run at the 82.00 level and possibly higher towards the 82.50 level. Its daily RSI is bullish and pointing higher supporting this view.

Conversely, as long as it continues to trade below its declining trendline, expect a push back lower. Support lies at the 80.50 level where a violation will aim at the 80.00 level.

Further down, support lies at the 79.75 level with a turn below here paving the way for a run at the 79.00 level. All in all, the Index continues to face upside threats in the short term.

Guest post by FX Tech Strategy