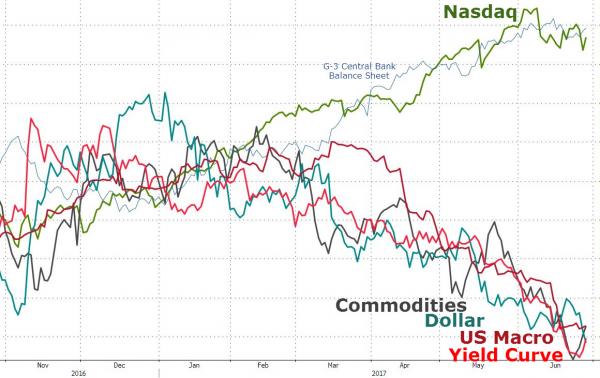

As we noted earlier… there’s only one thing standing…

Â

Before the US cash open, The ECB desperately tried to jawbone back Draghi’s comments from yesterday… it was met with an instant reaction lower (in Bund yields and EUR/USD) but the rest of the day saw that reaction entirely erased…

Â

The ECB chatter did impact US equities early on…

Â

Nasdaq was crazy today, with chaotic moves all over the place as every effort was made to ensure the tech-heavy index closed above the May close of 6198.5…

Â

The bounce occurred right at the 50DMA…

Â

FANG Stocks bounced off the tech-wreck day lows…

Â

The entire equity complex saw v-shape recovery today.. which started at 10ET following dismal home sales data…NOTE – Dow, S&P, Trannies, and Small Caps went nowhere after Europe closed, Nasdaq kept on running. Little selling pressure into the close…

Â

Nasdaq was unable to recover yesterday’s losses and the S&P ended unch from Monday’s close…

Â

The driver of the panic-bid – simple – another huge short-squeeze at the open and lasted through the European close… (today was  the biggest short-squeeze since the first day of March)

Â

Banks were bid and Utes were offered today ahead of the stress test results…

Â

As rates and the yield curve has plunged in June, so the big banks have been bought…round-tripping today from the CAR results last week…

Â

Despite the manic buying in stocks, bonds limped only 1-2bps higher (with 2Y yields actually down 2bps on the day)…

Â

The Dollar Index extended its losses after Carney and Poloz comments in Sintra… the Dollar Index is now at pre-Fed-hike levels…

Â

Funnily enough USD/JPY (green below) was deadstick as everything flew around in FX land (and Kuroda warned the world that “there’s no magic wand.”)