Interest rates and stocks are going…

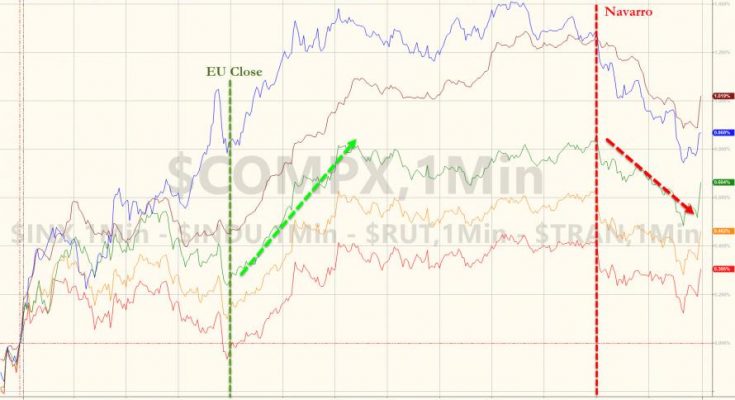

Stocks opened confidently (after for once trading sideways overnight), then slipped into the European close (Italian headlines) before ramping into the last hour when Navarro headlines spooked stocks and bonds…

Â

The post-Navarro weakness in stocks took all but Small Caps back into the red for the week…

Â

Russell 2000 broke to a new record high…

Â

On the back of a major short squeeze once again…

Â

Big Bank stocks were mixed after ramping on the European close (not helped by Italian bank weakness), they slid into the close after Navarro headlines…

Â

Small bank stocks underperformed as Small Caps soared to record highs…

Â

TSLA bonds pushed lower in price once again but the stock managed gains on the back of Soros buying converts in Q1…

Â

Treasury yields traded in a narrow range but the trend was higher…

Â

But 10Y pushed to a new cycle high this afternoon after Navarro headlines…

Â

The long-end of the US Breakevens curve has now inverted…

Â

But all eyes were on Italy where BTP spreads exploded on “Debt Cancellation” talk..

Â

The Dollar ended the day modestly lower, also trading in a very narrow range on the day – and unable to make a higher high…

Â

The Argentine Peso slipped lower again today after yesterday’s huge intervention…

Â

Cryptocurrencies were largely flat on the day but Bitcoin Cash slipped lower after its fork…

Â

Commodities all made gains on the day but WTI remain sthe big winner on the week and gold the laggard…

Â

Finally consider that Small Caps are being touted as domestically focused – amid fears of global trade wars etc… – but US domestic economic data is dismal…

Â

Â