Leading Indicators

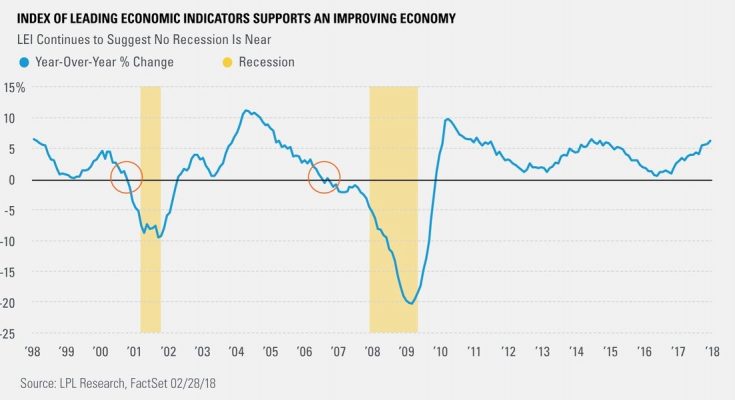

The economic data is important to my thesis which states you should be buying stocks at these prices. It may not seem like the economy moves stocks, but fundamental investors might not react within the minute a report is released like the algorithms do after a geopolitical event occurs. The chart below shows the year over year change in the leading indicators which I discussed last week on a month over month basis. As you can see, the indicators aren’t close to falling to the negatives which would be forecast a recession. One interesting factor which isn’t seen by looking at this chart is the adjustments in the data after the fact don’t make the indicator look like it did at the time the results came out. That being said, we aren’t in 2012 or 2016 when the index was close to the flat-line, so a recession is clearly not going to occur this year.

(Click on image to enlarge)

Chicago Fed Activity Index

On Monday, the Chicago Fed National Activity Index for April was released showing more positive results as the report of 0.34 beat the consensus for 0.25. The March number was revised up from 0.10 to 0.32 and the 3 month moving average went from 0.23 to 0.46 which is the highest point since January 2015. The index was led by manufacturing and employment. Only 51 of 85 indicators are included in this report which is why there are sharp revisions like we saw with March. The index reading is set up that 1.00 means the economy is overheating and throwing off excess inflation, meaning we’re not near that level yet.

Strong Richmond Fed Reports

The May Richmond Fed Manufacturing report was great just like the NY and Philly Fed manufacturing reports. The index was 16 which was above the consensus for 10. The highest estimate was 16. Last month was -3, showing how much this month improved. The chart below combines each regional Fed index to show how the economy improved back to the levels seen earlier in the year. Early in the year when manufacturing was strong, I was worried that we were near the peak of the cycle. At first my worries were verified, but now they are being alleviated. I think Trump’s plans are specifically targeting the manufacturing sector, which explains the improvement.