Image Source:

Image Source:

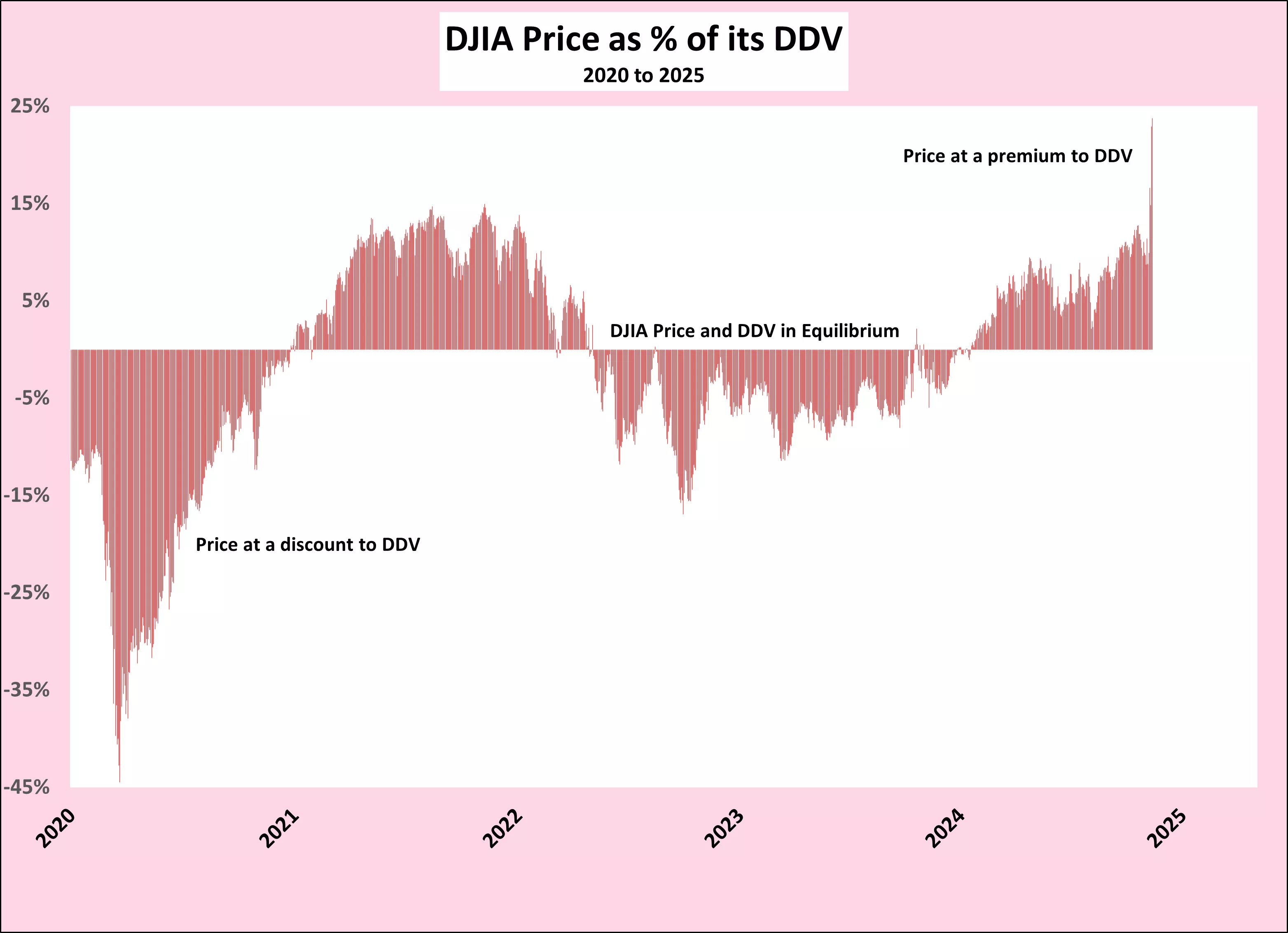

This is a follow-up to my article of Nov. 4, 2024: “.”Over the past week, the premium of the DJIA price to its DDV has gone into overdrive, The result of a misguided belief in a repeat of Trump’s first crack at being President

On election day November 2016, the DJIA price was at a 25% discount to its DDV. It moved towards equilibrium following the Trump tax cuts but fell back to a 45% discount as COVID-19 shattered world markets, in March 2020. Today Trump is starting with the price of the DJIA at a 24% premium to its DDV, the largest percentage differential since 2002.

The National debt stood at $21 trillion when Trump was first elected, today it is $36 trillion. Interest was running at $259 billion, today it is pushing $1 trillion. Since last November, Janet Yellen has refinanced in the short end of the Treasury market. There appears now to be no other choice but to revert to the long end which is pushing up the 30-year T bond rate above the minimum 4.5%, which along with the rebalancing of the constituents of the DJIA is forcing the DDV down.

Another way of looking at the above is the following chart of the difference between the price of the DJIA and its DDV which is at its highest in over half a century.

With wage demands rising to catch up with past inflation, new price inflation on the horizon from proposed tariffs and the threatened deportation of up to 20 million workers (at an estimated $88,000 each) from the labour force, it seems that Trump will have no choice but to forego the extension of his 2017 tax cuts and may even have to raise taxes to avoid the 2028 social security crunch. Perhaps, a royalty on oil production to pay for all the proposed spending which looks now likely to come from more borrowing. And on and on and on.This is not the time to buy a grossly overpriced DJIA. Such action will end in tears.More By This Author:

DJIA Grossly Overpriced Vs. DDV