PVD provides outstanding income in a ZIRP world.

US-based insurance giant MetLife (MET) offered to buy 100% of AFP Provida (PVD) last year but ended up owning about 93% after the Latin America and American tender offers were complete.

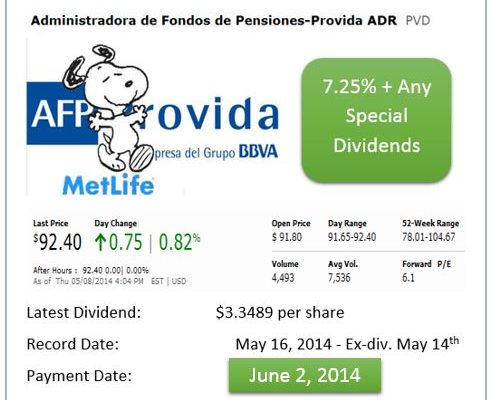

We were able to pick up shares duirng low volume sell-offs from fund managers who might have been worried whether the company’s future dividend policy would mimic the past. Now we have the answer. PVD declared a $3.35 semi-annual dividend this week. The stock will go ex-dividend on Wednesday, May 14th with payment scheduled in early June.

Â

All by itself that semi-annual payment would provide a juicy 7.25% yield at Thursday’s closing quote of $92.40. Last year the company also paid an additional $7.98 per share via two special payouts.

Â

Â

Â

I fully expect that MetLife will seek to obtain 100% ownership through a non-voluntary buyout of all remaining shares and American Depository Shares (ADS) at some point in the future. Any new offer, forcing old shareholders to sell to MET, would likely have to come at a higher number than the 2013 tender’s price. Until then, I plan to hold my high-yielding position with an eye towards adding on any temporary pullbacks.

Â

Disclosure: Market Shadows Virtual Value Portfolio and  my personal accounts are long PVD.