The months keep rolling on which is a little sad considering how fast it’s flying by but on the other hand we get to write about our monthly dividend income reports which is always fun. After all, creating a rising passive dividend income stream is really why we are all here. Whether we’re looking to be 100% reliant on this income sometime in the future or just want a little extra help to supplement our other income streams in retirement, the end goal is always the same. With that being said let’s take a look at my April dividend income.

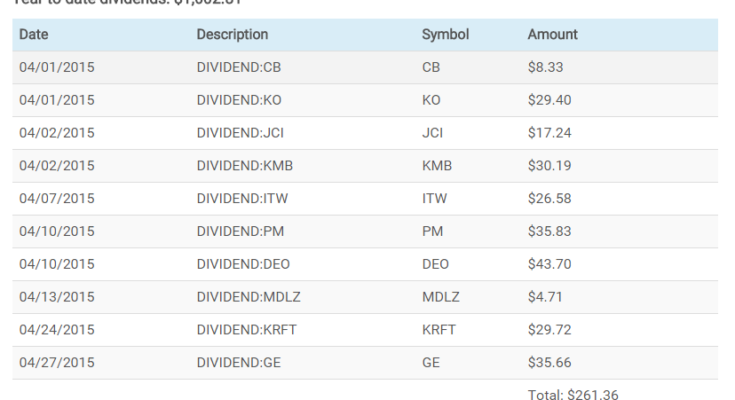

Dividend income from my taxable account totalled $261.36 up from $175.03 an increase of 49.32%from April of last year.

Dividend income from my ROTH account totalled $94.80 up from $25.34 an increase of 274.11% from this time last year.

Clearly, the huge year over year increase in my ROTH account can be attributed to my near monthly buys of the large Canadian banks, TD, BNS and RY for the last ten months. That dividend snowball should really be rolling now. Going forward I’m excited to receive my first dividend distributions from my newly created IRA account which include three new health care REITs, HCP, HCN and VTR.

My year to date dividends from my brokerage account is $1,002.81 and from my ROTH account $287.57.

Are any of the names below in your portfolio too? How was your April dividend income?

Brokerage Account

ROTH Account

Â