Dividend growth investing is a very popular approach which can fit within the ModernGraham methods. This article will look at companies reviewed by ModernGraham which have grown their dividends annually for at least the last 20 years.

Recently, I began tracking the number of years a company has grown its dividend, and providing that information in my individual company valuations. I have covered 365 companies since that tracking began. Eventually I will have this data on each of the more than 550 companies covered by ModernGraham, so this list should continue to grow for the next few months.

Out of the 365 companies on which IÂ have dividend growth data, only 46 have grown dividends annually for at least the last 20 years. Here is an overview of those companies:

The Elite

The following companies have been rated as the most undervalued and suitable for either the Defensive Investor or the Enterprising Investor:

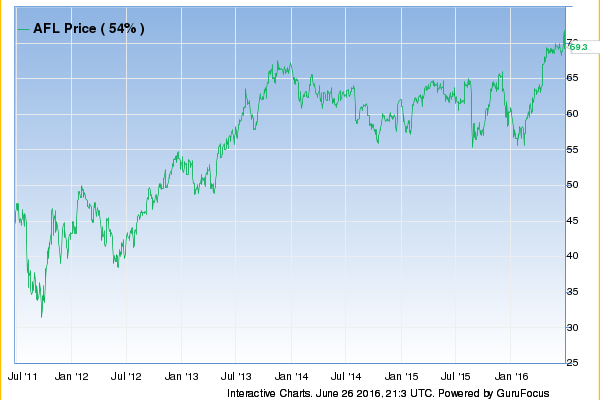

AFLAC Incorporated (AFL)

Aflac Inc qualifies for both the Enterprising Investor and the more conservative Defensive Investor.  In fact, the company passes all of the requirements of both investor types, a rare accomplishment indicative of the company’s strong financial position. As a result, all value investors following the ModernGraham approach based on Benjamin Graham’s methods should feel comfortable proceeding with further research.

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $4.72 in 2012 to an estimated $6.24 for 2016.  This level of demonstrated earnings growth outpaces the market’s implied estimate of 0.40% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Franklin Resources, Inc. (BEN)

Franklin Resources Inc qualifies for both the Enterprising Investor and the more conservative Defensive Investor. In fact, the company passes all of the requirements of both investor types, a rare accomplishment indicative of the company’s strong financial condition. As a result, all value investors following the ModernGraham approach based on Benjamin Graham’s methods should feel comfortable proceeding with further research.

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $2.50 in 2012 to an estimated $3.17 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.00% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Dover Corp (DOV)

Dover Corp qualifies for both the Enterprising Investor and the more conservative Defensive Investor. The Defensive Investor is only concerned by the low current ratio and the Enterprising Investor’s only concern is the level of debt relative to the net current assets. As a result, all value investors following the ModernGraham approach based on Benjamin Graham’s methods should feel comfortable proceeding with further research.

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $3.58 in 2011 to an estimated $5.07 for 2015. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.88% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)

Illinois Tool Works Inc. (ITW)

Illinois Tool Works Inc qualifies for both the Enterprising Investor and the more conservative Defensive Investor.  The Defensive Investor’s only concern is the high PB ratio while the Enterprising Investor is only concerned with the level of debt relative to the net current assets.  As a result, all value investors following the ModernGraham approach based on Benjamin Graham’s methods should feel comfortable proceeding with further research.

As for a valuation, the company appears to be undervalued after growing its EPSmg (normalized earnings) from $3.18 in 2011 to an estimated $5.47 for 2015. This level of demonstrated earnings growth outpaces the market’s implied estimate of 3.95% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price. (See the full valuation)