T. Rowe Price Group (TROW) was founded in 1937 by Thomas Rowe Price, Jr. Today, the company has a market cap of $16.6 billion and manages over $770 billion in assets. It now has more than 6,000 associates in 16 offices worldwide.

The company provides mutual funds, advisory services, and separately managed accounts for individuals, institutional investors, retirement plans, and financial intermediaries.

T. Rowe Price has grown into a massive, global financial institution by abiding to its founder’s key principles. Three of these principles are to:

- Put clients’ interests first

- Act with accountability

- Be disciplined and risk-aware.

These values have helped T. Rowe Price greatly enrich its shareholders over the past several decades. The company is a Dividend Aristocrat and has raised its dividend for the past 30 years.

There are only 50 Dividend Aristocrats; stocks with 25+ years of consecutive dividend increases in the S&P 500. You can see the full list of Dividend Aristocrats here.

Keep reading this article to learn more about the investment prospects of T. Rowe Price Group.

Business Overview

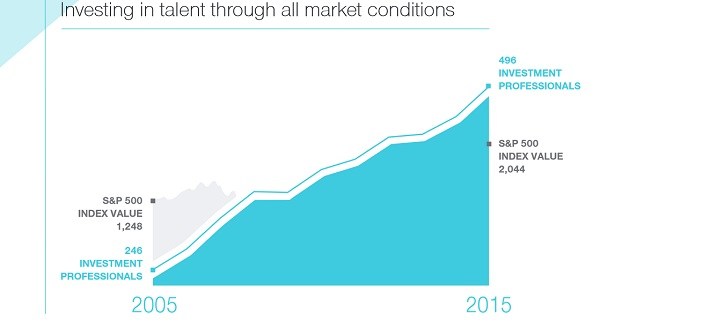

Another of T. Rowe Price’s guiding principles is to invest in its employees, which it considers its most valuable assets.

Indeed, it is critical for a financial services company to have qualified experts in the financial industry.

Source:Â 2015 Annual Report, page 15

The strategy worked for the company, as T. Rowe Price significantly grew revenue and operating profit from 2011-2015.In that period, the company’s net revenue and net profit grew by 53% and 58%, respectively.

Note: Fellow asset management Dividend Aristocrat Franklin Resources follows a similar strategy of investing heavily in the best financial professionals it can find.

Source:Â 2015 Annual Report, page 22

The biggest reasons for T. Rowe Price’s impressive growth in that time was the strong performance of the stock market. The S&P 500 and other global markets rose significantly in the aftermath of the Great Recession, which naturally resulted in a significant rise in assets under management.