In part 15 of the 54 part series on Dividend Aristocrats we will look into the operations of asset manager Franklin Resources (BEN). Franklin Resources manages the Franklin family of mutual funds and the Templeton family of mutual funds. The company was founded in 1947 and has paid increasing dividends for 33 consecutive years. Franklin Resources is the 4th largest publicly traded asset management company by market cap, behind only BlackRock (BLK), The Bank of New York Mellon (BK), and The Blackstone Group (BX).

Business Overview

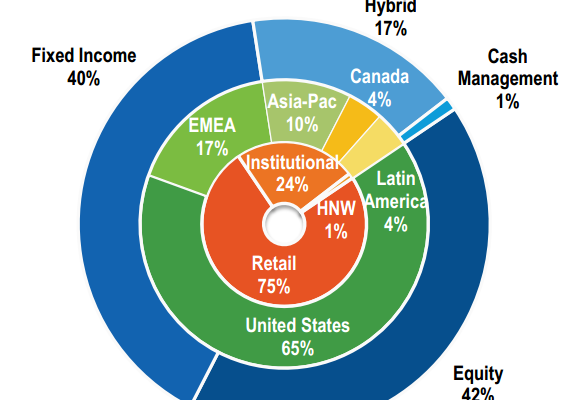

Franklin Resources is well diversified in many aspects. The company’s funds are split nearly evenly between equity and fixed income markets. Franklin Resources is somewhat geographically diversified, with 65% of assets under management in the U.S. and 35% of assets under management coming from international markets. The company is also diversified between retail and institutional investors. About 75% of assets under management come from retail investors, with 24% coming from institutional investors and 1% from high net worth individuals.

Despite having just 35% of assets under management in international markets, Franklin Resources has taken great strides to set up sales and research offices throughout the world. It has had the most success so far in Canada, Italy, and Germany.

Competitive Advantage

Franklin Resources competitive advantage comes from its global research team and the strong performance of its funds which routinely rate in the top 50% of their respective peer group. Currently, 88% of the company’s funds rank in the top 50% of their peer groups over a ten year period.

The company has realized this strong performance on the strength of its research team. The company takes a disciplined approach to fund investing. Moreover, Franklin Resources has offices located around the globe which gives the company an advantage in international investing that smaller asset managers simply cannot recreate. The image below shows the various research offices Franklin Resources has established over the last several decades to build an edge in international investing.