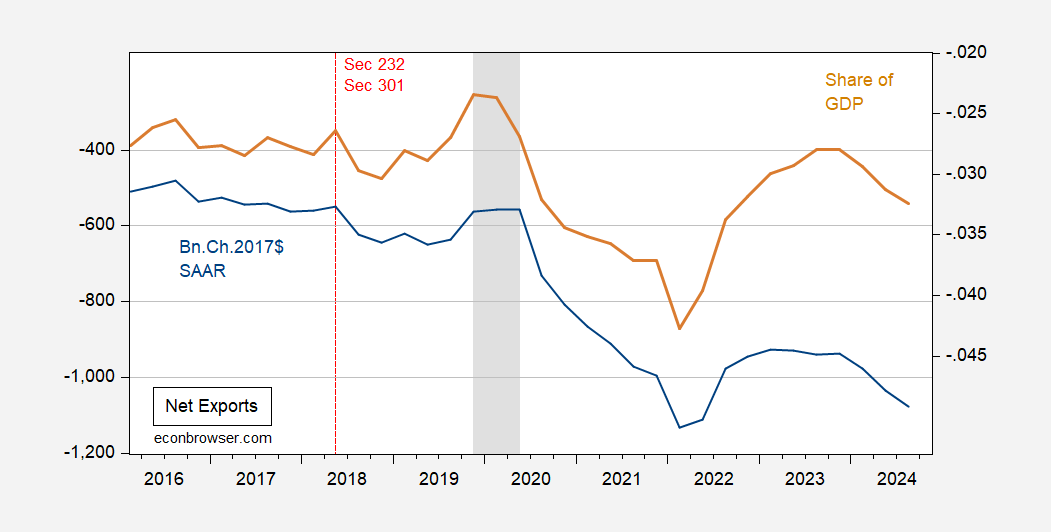

Answers: No. No. No.(Click on image to enlarge) Figure 1: Net exports in bn.Ch.2017$ SAAR (blue, left scale), nominal as share of GDP (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Figure 1: Net exports in bn.Ch.2017$ SAAR (blue, left scale), nominal as share of GDP (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

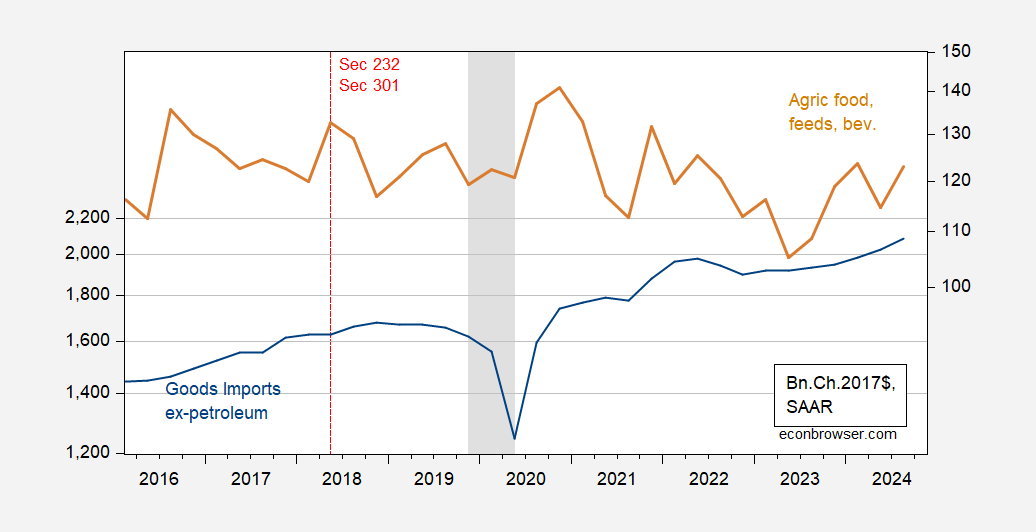

Not only did net exports fall in volume by the end of Trump 1.0, so too did the net export share of GDP.(Click on image to enlarge) Figure 2: Imports ex-petroleum, (blue, left scale), agricultural food, feeds and beverages (tan, right scale), in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.Ag exports fell pre-pandemic, and only rose in the post-pandemic ag boom. Imports of goods excluding petroleum were higher by the end of Trump 1.0.This might seem surprising if one focused on the expenditure switching aspects of tariffs, and thought foreign countries would not retaliate against US exports. On the latter, that always seemed silly to me. On the former, it’s important to remember that in a Mundell-Fleming model under floating exchange rates, the exchange rate will tend to appreciate, thereby offsetting in part the expenditure switching effect (even ignoring retaliation aimed against US exports). Also, if economic policy uncertainty rises with trade wars then one can expect yet more dollar appreciation, tending to push up imports.More By This Author:

Figure 2: Imports ex-petroleum, (blue, left scale), agricultural food, feeds and beverages (tan, right scale), in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER.Ag exports fell pre-pandemic, and only rose in the post-pandemic ag boom. Imports of goods excluding petroleum were higher by the end of Trump 1.0.This might seem surprising if one focused on the expenditure switching aspects of tariffs, and thought foreign countries would not retaliate against US exports. On the latter, that always seemed silly to me. On the former, it’s important to remember that in a Mundell-Fleming model under floating exchange rates, the exchange rate will tend to appreciate, thereby offsetting in part the expenditure switching effect (even ignoring retaliation aimed against US exports). Also, if economic policy uncertainty rises with trade wars then one can expect yet more dollar appreciation, tending to push up imports.More By This Author:

Did The Trade Balance Improve With Tariffs? Did Imports Fall? Did Ag Exports Rise?