A few years ago, I wrote an issue for Boom & Bust outlining the biggest problems in the Eurozone after the QE-stimulated recovery that saved the banks and financial system from going under. The point made was that Italy was still bankrupt at the banking level, and in dangerous levels of public debt. Deutsche Bank was not recovering with other banks, and instead was languishing near the lows with other major Italian banks…

I looked at Italy in a recent . And now I want to update you on Deutsche Bank, as it has recently hit new lows since late 2016 and the crash in early 2009.

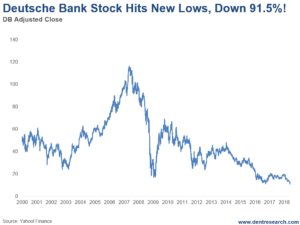

How could such a prominent bank be hitting new lows after over nine years of an economic recovery, albeit a more reserved one?

(Click on image to enlarge)

This stock peaked on May 11, 2007 at $116.40 at its close (with an $152.44 intraday high). It crashed down to a low of $17.20 on February 23, 2009, an 85.2% loss. After rallying a bit in 2009, it recently hit a substantial new low of $11.00 on June 5…

That’s down 91.5% from its all-time high.

This, again, only topped a by a few large banks in Italy. It’s a clear sign of trouble for Germany’s flagship bank, and will almost certainly go under in the coming years if it’s performing this badly now.

I’ll keep it simple: Deutsche Bank had, and still has, the highest exposure to derivatives – the most toxic and most leveraged of financial assets – of any bank in Europe, and globally.

And like many large French banks, it has a lot of bad loans, especially to ailing Italian companies.

Deutsche Bank is the most obvious sign of how challenging the bad debt situation still is in the Eurozone, with Italy, alone, housing 40% of the non-performing loans.

Now, let’s contrast that with the U.S…

(Click on image to enlarge)

The S&P Bank ETF shows U.S. banks are doing much better. But from how we see things, they’re still in trouble if there’s a recession (depression) and housing crash worse than last time – as I expect to happen.