Deflation risk seems to be making a comeback… again. Germany yesterday sold five-year government notes at a negative yield for the first time in its history. Meanwhile, China’s central bank this week warned that the threat of deflation is rising for the world’s second-largest economy. Europe and Japan, of course, continue to struggle with lowflation/deflation. The US is doing better, thanks largely to stronger growth, but inflation is low and may get lower still. “The problem is that aggregate prices are dipping in so many places at once,†The Economist reminds.

Today’s update on US consumer prices is expected to deliver more of the same. Headline inflation is projected to turn a deeper shade of red in the monthly comparison for January—a decline of 0.6% vs. a 0.4% slide in the previous month, according to the consensus forecast via Econoday.com. Core inflation will remain relatively steady and slightly positive, economists predict, but the general outlook is for low inflation with the potential for a downside bias.

The Fed’s Janet Yellen yesterday reiterated that the central bank would prefer to see inflation moving closer to its 2% target before it begins raising interest rates. At the moment, however, that’s an unlikely scenario. Year-over-year inflation is running at roughly half the Fed’s target, although Yellen cited forecasts that see higher levels in the months ahead. She also said that lowflation wouldn’t necessary be a deal breaker for tightening monetary policy; instead, the labor market would remain the key variable for deciding when to start hiking rates.

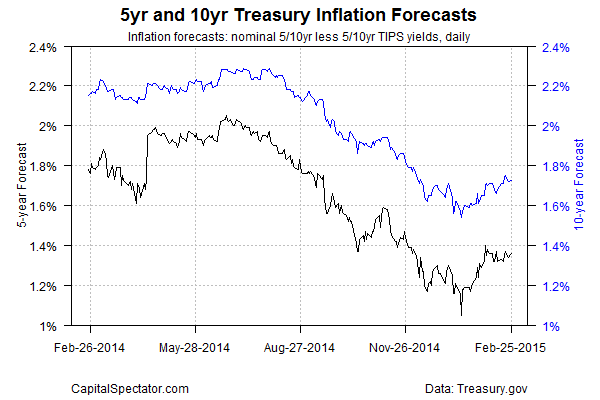

There’s a degree of support in the Treasury market for thinking that inflation may inch higher. Implied inflation expectations via the yield spread on nominal and inflation-linked government bonds are modestly higher, albeit after a months-long slide.

The question, of course, is whether US inflation can move closer to the Fed’s 2% target at a time when the rest of the world is battling disinflation/deflation? Perhaps if energy costs are now set to stabilize we’ll have a foundation for firmer pricing generally. Confidence for this scenario will get a boost if the recent signs of growth in the Eurozone turn out to be more than another false dawn.