Ask any European why their standard of living is so atrocious (after years of freeflowing debt-funded largesse) and the answer is well-known:Â austerity.

Also ask any European if austerity means public debt should go up or down and the answer is also as clear:Â down.

Which is why most Europeans will likely be confused to very confused when presented with the latest Eurostat data according to which not only did Eurozone debt rose remain just shy of all time record highs and certainly increasing from a year ago, but those PIIGS nations which are the first to blame austerity for everything, such as Greece (net of the debt wiped out as part of its 2012 bankruptcy of course), Portugal, Spain and Italy, all saw their public debt hit all time highs.

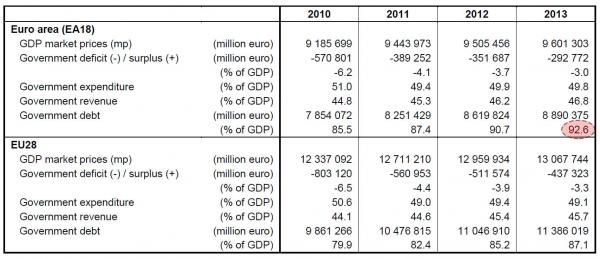

Total Eurozone debt closed 2013 at a level of 92.6%, just shy of its all time high and up from 90.7% a year ago, 87.4% two years ago, and so on.

Where did the bulk of the debt growth in the quarter come from? The usual suspects: Greece, Slovenia and Croatia.

Compared with the third quarter of 2013, twelve Member States registered an increase in their debt to GDP ratio at the end of the fourth quarter of 2013, fourteen a decrease and two remained stable. The highest increases in the ratio were recorded in Slovenia (+9.2 percentage points – pp), Croatia (+5.2 pp) and Greece (+3.0 pp), and the largest decreases in Luxembourg (-4.6 pp), Belgium (-3.6 pp), Malta (-3.2 pp) and Austria (-2.9 pp).

Finally, the complete breakdown by nation. It is here that perhaps one has the biggest issues with the definition of austerity because it is quite clear that for all the screaming and yelling, Greek, Italian, Spanish and Portuguese debt and debt/GDP all rose across the board.