Mark Thoma wrote that the Fed should not have already raised its nominal Fed rate. He wrote that justifications for already raising the Fed rate are misguided. Now I am one who is saying that the Fed should have already raised nominal interest rates for two reasons…

- Potential output is lower than people think which raises the Fed rate determined by the Taylor rule.

- According to the Fisher Effect, inflation will follow nominal interest rates when the Fed rate is held constant or bound within a tight range for a long time.

Potential Output

When potential output is lower, the output gap to full employment is lower. According to the Taylor rule, a smaller output gap leads to a higher nominal rate. As the output gap closes at full employment, the nominal rate should return to its long run normal rate.

Thus I see that the Fed nominal interest rate would need to return to its “normal†level sooner. (Normal means natural real interest rate + expected inflation target, r + pe.) The normal nominal Fed rate is roughly 4%, based on a real natural rate of 2%, and the inflation target of 2%.

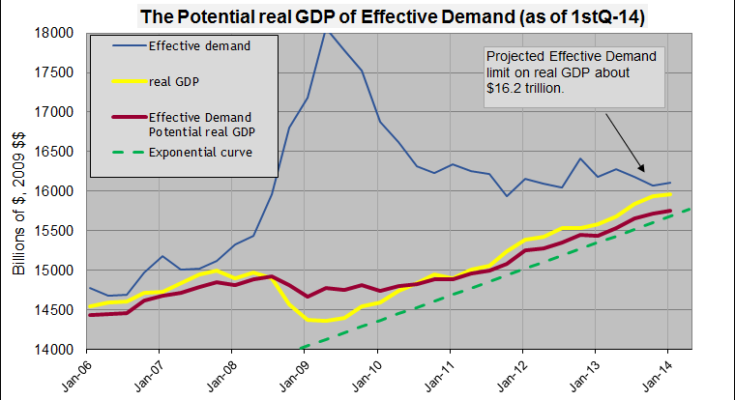

Here is how I see potential output (red line in graph)

Graph #1

Potential output has fallen to a new trend line since the crisis and is holding steady. This video explains how I determine potential output. I show that the government has been wrong about potential output. Likewise, they keep revising potential output downward but I can see how far down they really should be revising it. I have not had to revise my determination of potential output, as real GDP is trending steadily along my potential output.

Fisher Effect

Mark Thoma mentions the Fisher Effect, which uses the Fisher equation. i = r + pe. Nominal rate (i) is equal to real rate (r) + expected inflation (pe). As Mr. Thoma says…

“Some economists have argued that when policymakers hold the nominal interest rate at the zero bound, it is deflationary since r is positive, and pe = -r when i=0.â€

Mr. Thoma is responding to an error in logic that assumes that the Fisher effect is currently deflationary. I am not saying that the Fisher effect is deflationary, because I foresee the nominal rate rising above the natural real rate as we move toward full employment. Thus inflation will be low, but not deflationary.

However, the Fed has projected a Fed rate well below the “normal†rate. Mr. Thoma says…

“Although there have been many calls for the Fed to raise its target interest rate, the Fed has made it clear that it intends to keep its target interest rate abnormally low even after the economy is well into recovery. There may be some risk of inflation in this approach, but as noted above this risk appears to be small.â€