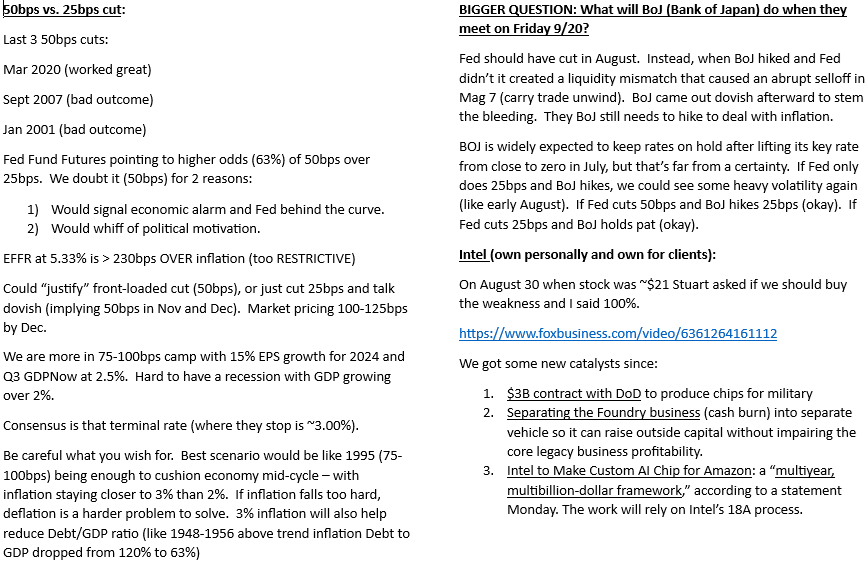

On Tuesday, I joined Stuart Varney on Fox Business to discuss Market Outlook, Fed, Bank of Japan and one holding. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on. You can find it here:Watch in HD directly on Fox BusinessHere were my show notes ahead of the segment:(Click on image to enlarge)

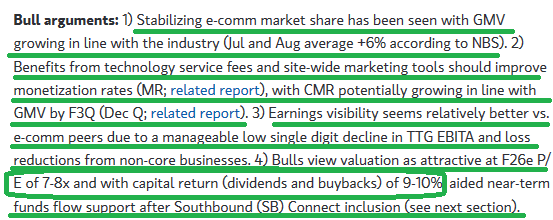

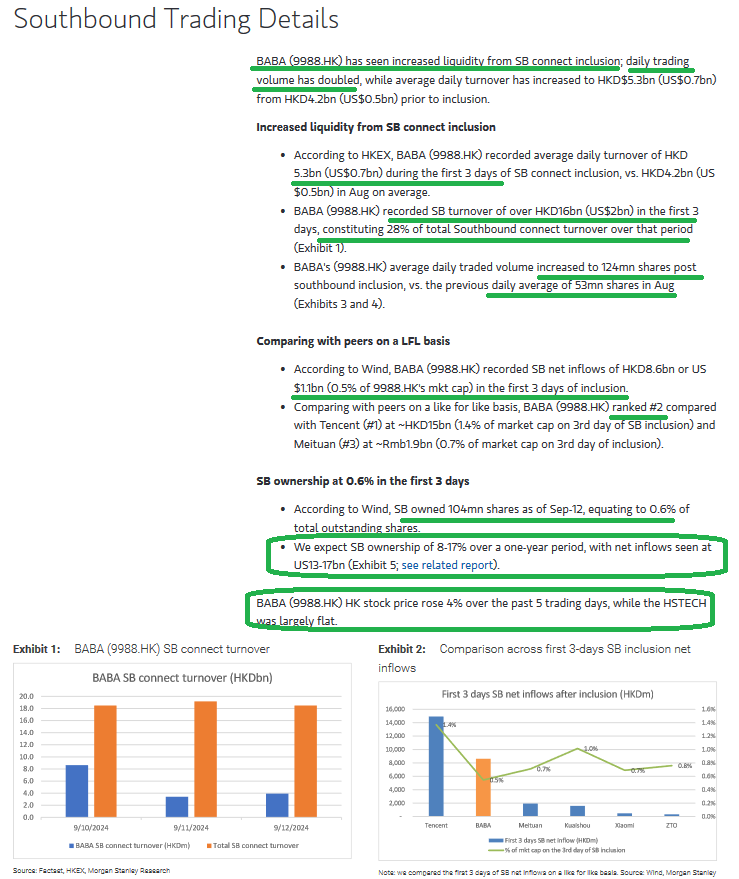

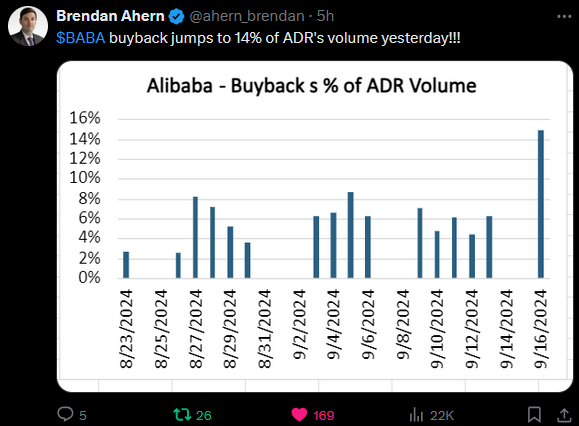

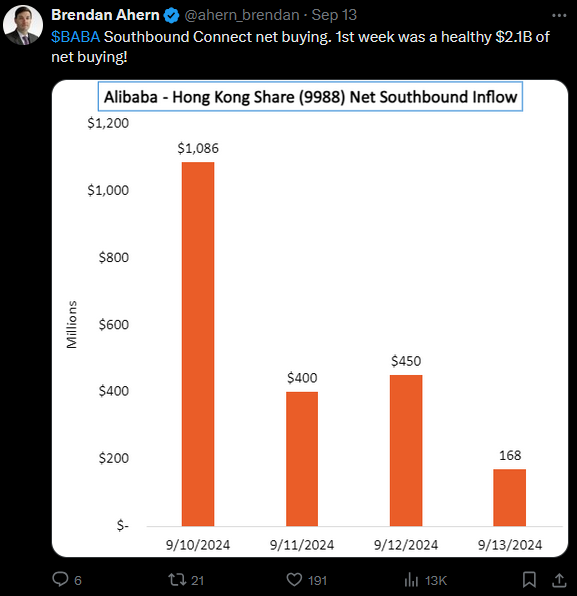

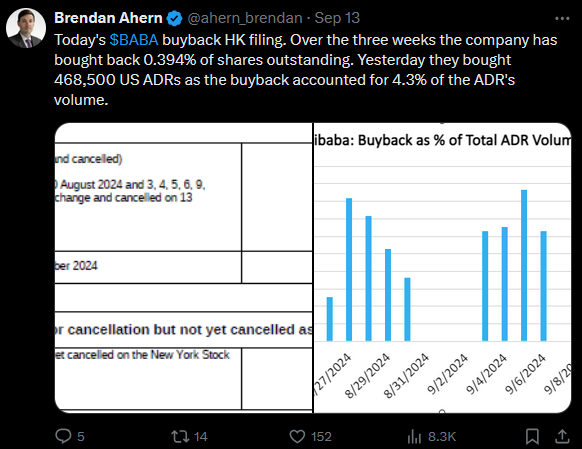

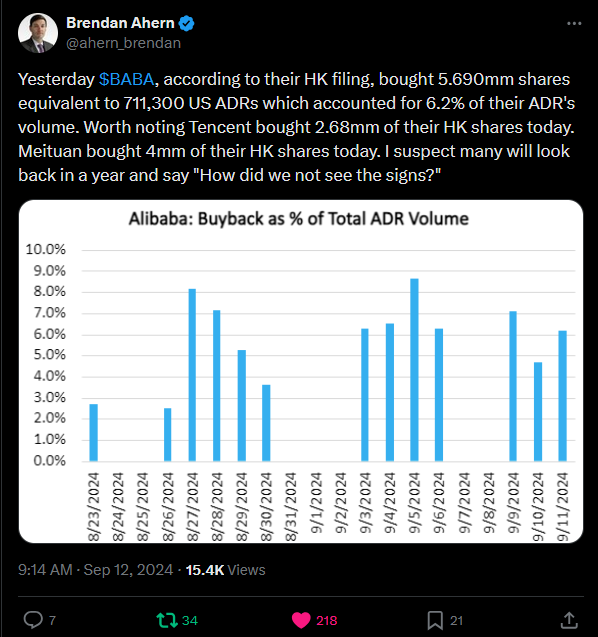

On Tuesday, I joined Stuart Varney on Fox Business to discuss Market Outlook, Fed, Bank of Japan and one holding. Thanks to Stuart, Christian Dagger and Preston Mizell for having me on. You can find it here:Watch in HD directly on Fox BusinessHere were my show notes ahead of the segment:(Click on image to enlarge) *Please read closely above regarding the significance of the FRIDAY BoJ decision vs. the Wednesday Fed decision. Intel UpdateAs I discussed on Varney & Co we’ve seen several positive catalysts in the last few days. directly from Pat Gelsinger on Monday evening Alibaba UpdateFrom Morgan Stanley post SB inclusion commentary (mainland closed M-W this week for Holiday):

*Please read closely above regarding the significance of the FRIDAY BoJ decision vs. the Wednesday Fed decision. Intel UpdateAs I discussed on Varney & Co we’ve seen several positive catalysts in the last few days. directly from Pat Gelsinger on Monday evening Alibaba UpdateFrom Morgan Stanley post SB inclusion commentary (mainland closed M-W this week for Holiday):

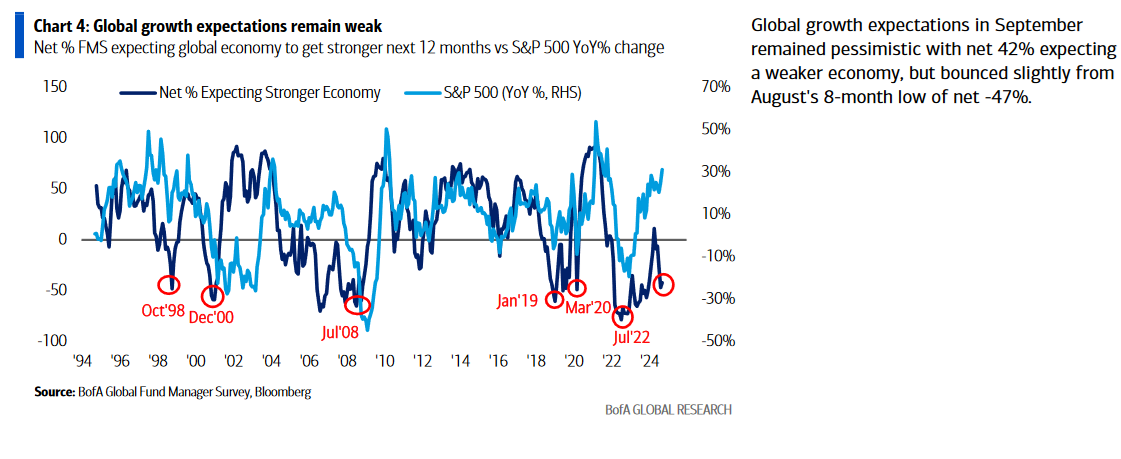

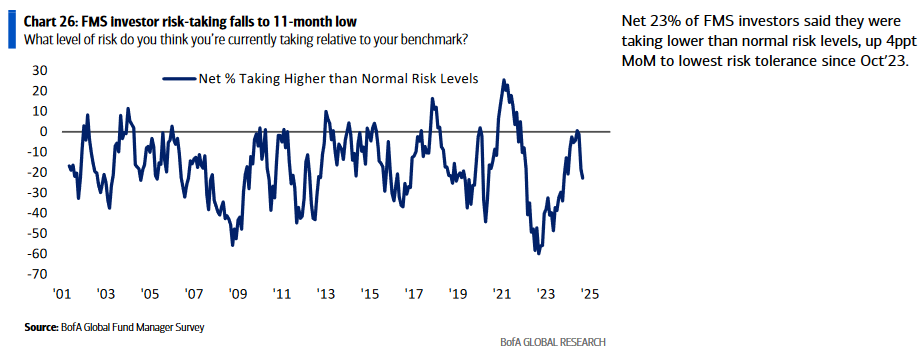

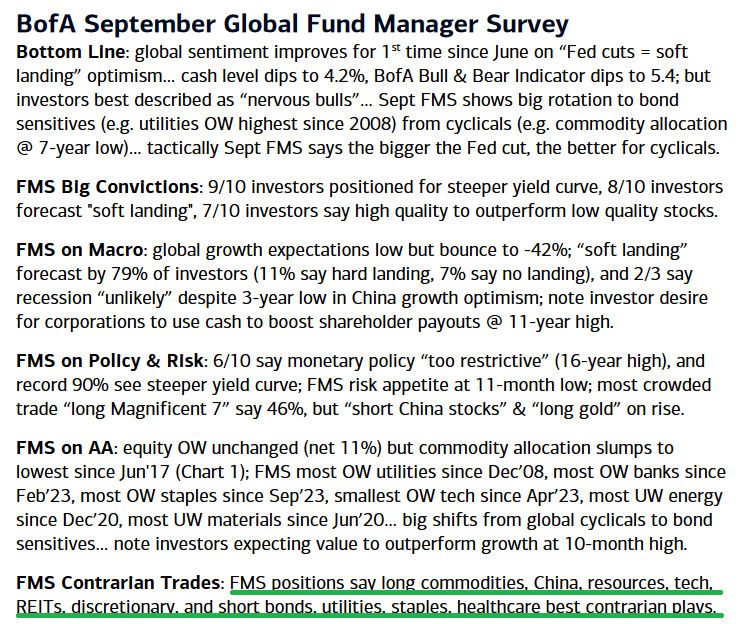

Bank of America Fund Manager Survey UpdateOn Tuesday, we put out a summary of the monthly This month they surveyed institutional managers with $593B AUM:Here were the key points:1. As well as markets have done, managers are still skeptical – which implies (after some normal seasonal volatility) markets can climb the “wall of worry” to new highs after the election:

Bank of America Fund Manager Survey UpdateOn Tuesday, we put out a summary of the monthly This month they surveyed institutional managers with $593B AUM:Here were the key points:1. As well as markets have done, managers are still skeptical – which implies (after some normal seasonal volatility) markets can climb the “wall of worry” to new highs after the election:

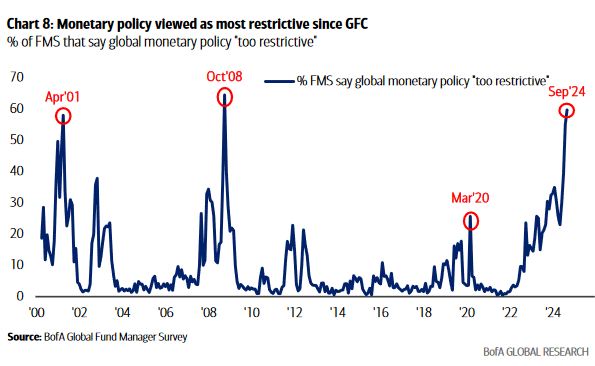

2. Managers belief that policy is too restrictive resembles prior periods that were near generational BUY areas, not tops to be SOLD:

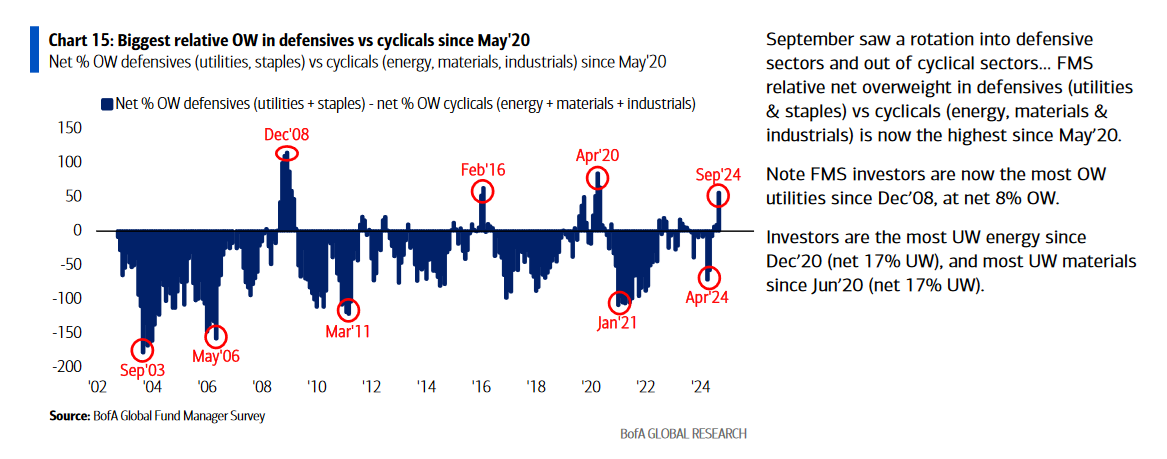

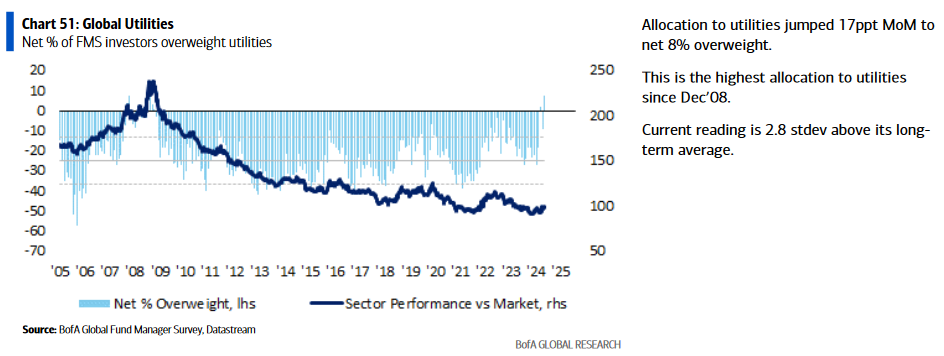

2. Managers belief that policy is too restrictive resembles prior periods that were near generational BUY areas, not tops to be SOLD: 3. Managers are too crowded into defensives setting the stage for cyclicals to do well over the next year (see utes below):

3. Managers are too crowded into defensives setting the stage for cyclicals to do well over the next year (see utes below):

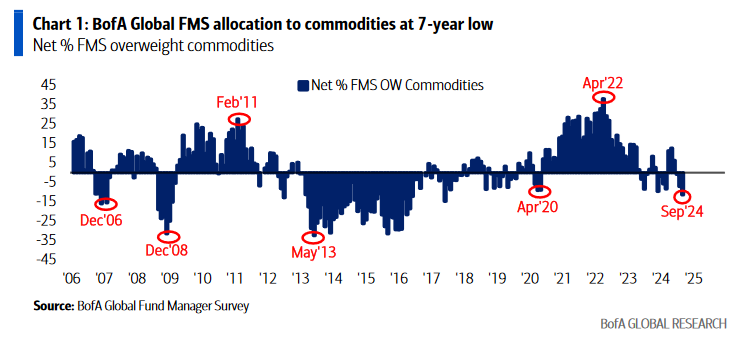

4. Opportunity setting up in commodities with managers at 7yr low exposure:

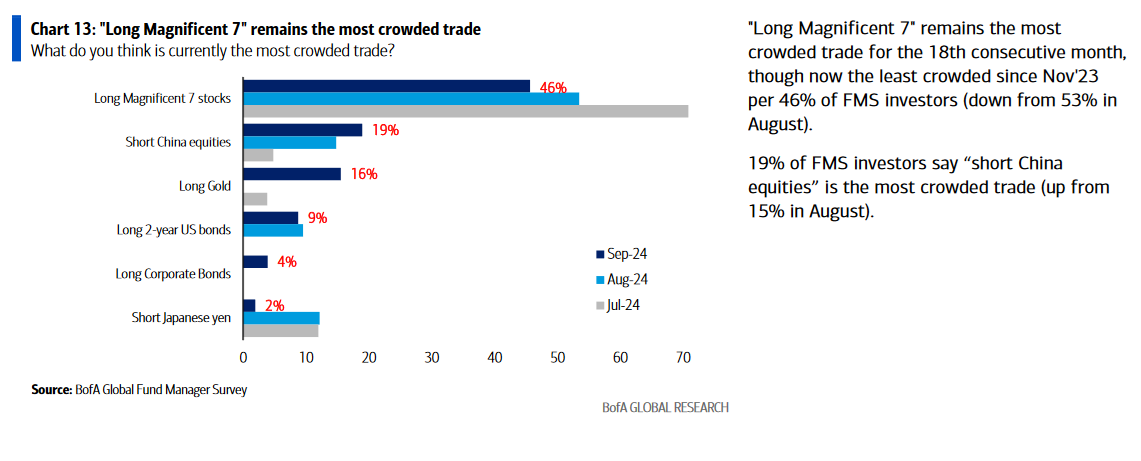

4. Opportunity setting up in commodities with managers at 7yr low exposure: 5. Long China equities setting up as best contrarian trade (currently one of most crowded shorts):

5. Long China equities setting up as best contrarian trade (currently one of most crowded shorts):

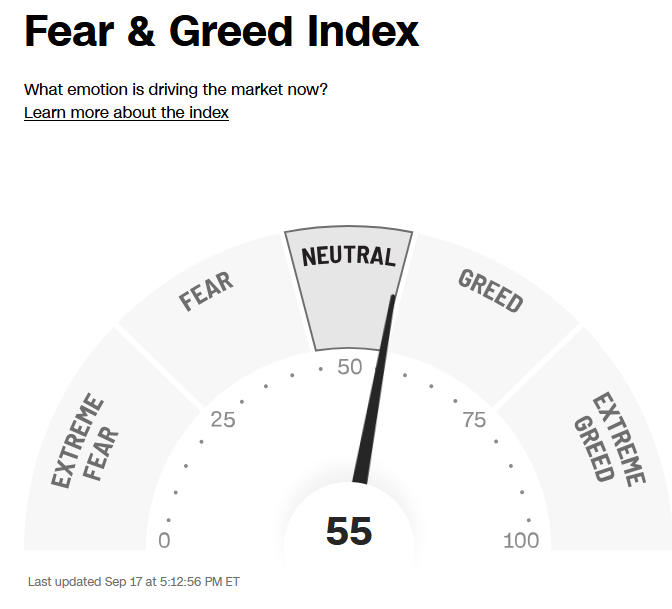

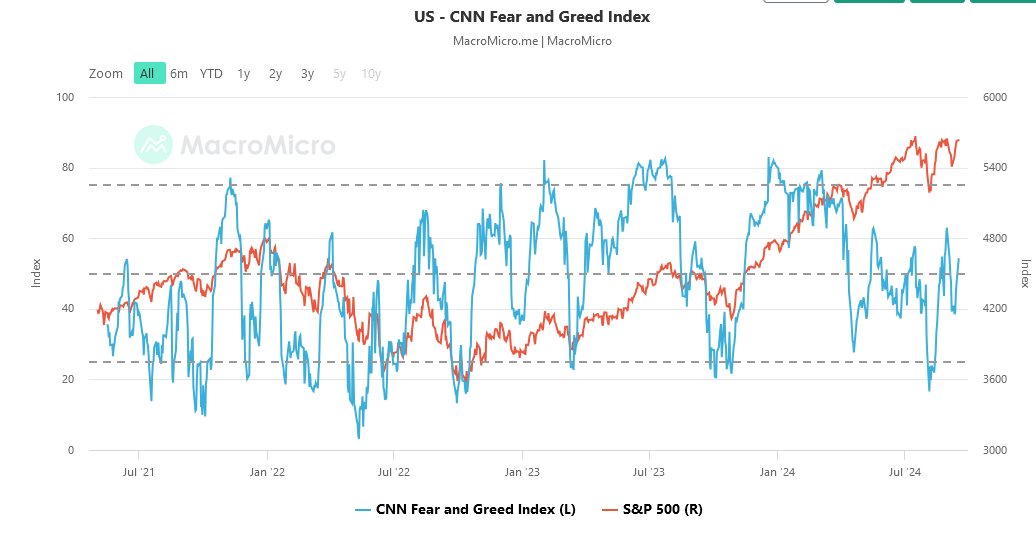

Now onto the shorter term view for the General Market:The CNN “Fear and Greed” moved up from 43 last week to 55 this week. You can learn how this indicator is calculated and how it works here: ()

Now onto the shorter term view for the General Market:The CNN “Fear and Greed” moved up from 43 last week to 55 this week. You can learn how this indicator is calculated and how it works here: ()

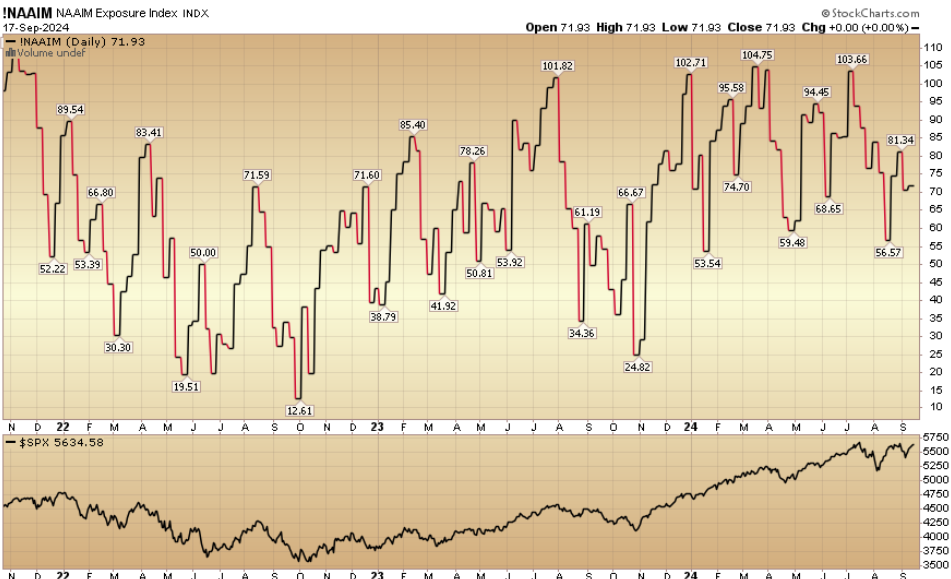

The NAAIM (National Association of Active Investment Managers Index) () ticked up to 71.93% this week from 70.65% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) () ticked up to 71.93% this week from 70.65% equity exposure last week. Our | will be out tonight or Friday night. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form .*Opinion, Not Advice. More By This Author:

Our | will be out tonight or Friday night. We’ll have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form .*Opinion, Not Advice. More By This Author:

“Decision Day” Stock Market (And Sentiment Results)