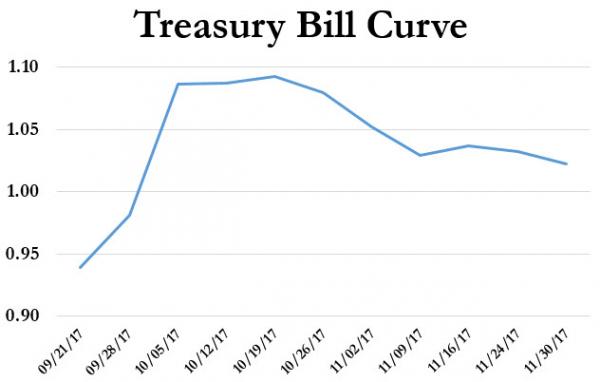

The US Treasury Bill market remains notably inverted around the uncertain timing of the US debt limit debacle.

As Bloomberg reports, while Treasury bills maturing in October continue underperforming against November and December securities, the market has a murky view on the drop-dead date for the U.S. debt ceiling.

At the start of last week, concerns shifted to early October after the Treasury said in its 3Q refunding statement that it expects to be able to fund the govt through the end of September.

Focus then shifted back toward mid-October after the head of the House Freedom Caucus said he is ready to accept a debt ceiling increase without other conditions

However, one more worrisome market is starting to notably wake up to the reality of a deeply divided congress unable to agree on anything. The market for sovereign credit risk is flashing red with USA 5Y CDS now trading at its most extreme levels to German 5Y CDS since Lehman.

Note that the current credit-risk-premium for US Treasuries is higher than it was during 2013’s government shutdown and 2015’s down-to-the-wire debt ceiling debate.

But while Treasury and credit markets are flashing red anxiety levels, the VIX curve is doing the exact opposite and pricing in a relative drop in volatility… before a resurgence in the start of 2018…

So T-Bills worry about early October… VIX worries about year-end… and CDS confirm they have a problem. Who will be right?