Overnight Gallup released its latest survey which confirmed just how dead the American Dream has become for tens if not hundreds of millions of Americans.

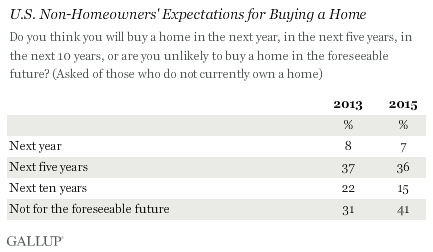

According to the poll, the number of Americans who do not currently own a home and say they do not think they will buy a home in “the foreseeable future,” has risen by one third to 41%, vs. “only” 31% two years ago.

Non-homeowners’ expectations of buying a house in the next year or five years have stayed essentially the same, suggesting little change in the short-term housing market.

As Gallup wryly puts it, “what may have been a longer-term goal for many may now not be a goal at all, and this could have an effect on the longer-term housing market.”

Shortly thereafter, the US Census released its latest homeownership data, which confirmed that for what is left of America’s middle class, owning a home has become virtually impossible, with the homeownership rate tumbling from 64.0% to 63.7%, which is tied for the lowest historic print since the first quarter of 1986, with the only difference that then the trendline was higher. Now, as can be seen on the chart below, it isn’t. At this rate, by the end of the 2015 and certainly by the end of Obama’s second term, the US homeownership rate will drop to the lowest in modern US history.

There is no surprise why this is happening. As Bloomberg notes, “entry-level buyers are struggling to save enough money to purchase homes as gains in U.S. real estate prices outstrip increases in wages, while mortgage lending remains tight. The median household income in March grew 2.1 percent from a year earlier while the median home price gained 7.8 percent in the same period. Last year, the share of home purchases by first-time buyers fell to the lowest level in almost three decades, according to the National Association of Realtors.”

“The No. 1 issue in the housing market right now is wages,†said Jay Morelock, an economist with FTN Financial in New York. “For the housing recovery to be sustainable in the long run, we have to see wages increase at a faster pace.â€