Late last month I wondered if lower yields were signaling higher risk? The question still resonates. Indeed, the benchmark 10-year Treasury yield is under 2.50% again, or near the lowest levels for the past year. This is a bit odd because US economic data continues to trend positive, although the housing sector still looks wobbly. Nonetheless, nonfarm payrolls and other major macro indicators betray no conspicuous warning signs at this time. In turn, the moderately upbeat profile on the economy suggests that the Fed will continue to wind down its quantitative easing program in the autumn, which lays the groundwork for raising interest rates next year. But there are risks bubbling around the world that are weighing on interest rates and so demand is rising for a safe haven in the world’s reserve currency.

“It’s been a difficult trade for most participants as economic fundamentals battle against geopolitical stuff,†a Treasury trader at UFJ Securities USA toldBloomberg yesterday. “It’s the fear of the Russia and Ukraine situation escalating. Unless you feel the economy will not recover, rates are too low.

Â

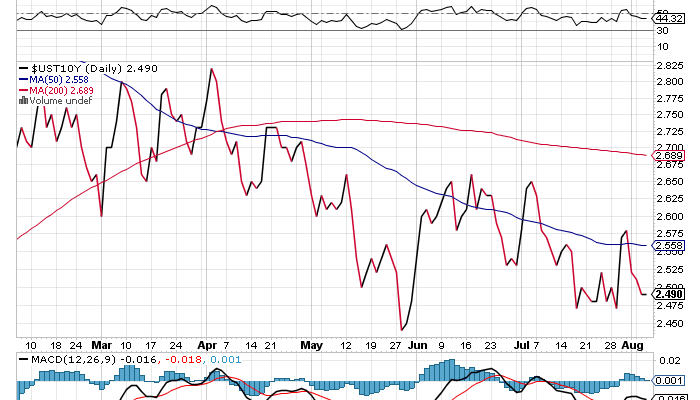

Earlier this week, Abigail Doolittle at Peak Theories Research noted the return of the so-called Death Cross for the 10-year Note—the recent decline of the 50-day moving average below the 200-day average for the 10-year yield:

In the case of the 10-year yield, however, this is actually a bullish signal for bonds with price trading inverse to yield as investors pile into the safety of Treasurys. Not surprisingly, many of those same investors “pile out†of riskier stocks as shown by the long black arrows pointing to the formal corrections that have occurred after or around the 10-year’s recent Death Crosses.

Put otherwise, the 10-year yield’s Death Cross has proven to be a pretty significant risk-off shot across the bow over the last decade and this is true before, during and after the Fed’s rounds accommodation.