Utility sector ETFs and mutual funds are in the Danger Zone this week. The pickings in this sector are slim as every single ETF and mutual fund earns a Dangerous or Very Dangerous rating. The Utilities sector ranked last in our Sector Rankings report.

In this market environment, it’s not unusual for a sector to not have any Attractive funds. In fact, only Consumer Staples and Financials currently have any Attractive-or-better rated funds. However, the inability of any Utilities fund to even earn a Neutral rating is surprising. Every other sector manages to have at least one fund with a Neutral rating.

We put the Utilities sector in the Danger Zone towards the end of 2012, and sure enough it lagged the market significantly in 2013. However, as momentum stocks have turned over in 2014, investors have fled to high dividend Utilities. This rotation has driven the Utilities SPDR (XLU) up 14% so far this year. The false equivalency that dividends=safety has led investors to ignore the significant risks and bloated valuations of the stocks that Utilities funds hold. The truth is that Utilities funds have poor holdings and should continue to underperform the market going forward.

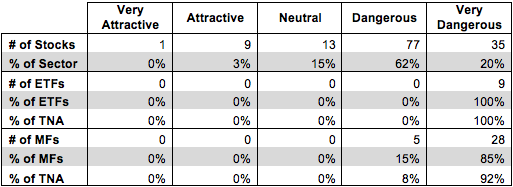

In fairness to Utility fund managers and ETF providers, there is a paucity of quality stocks in the sector. Figure 1 shows the breakdown of our ratings for Utilities stocks, ETFs, and mutual funds.

Figure 1: Utilities Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Figure 1 actually overstates the quality of the stocks available in the Utilities sector. The one Very Attractive stock, Inteliquent (IQNT) is actually a Telecom stock, and 7 of the 9 Attractive stocks are actually outside the Utilities sector as well, like Master Card (MA) and Verizon (VZ). In the search for quality stocks, fund managers seem to be broadening the definition of “Utilityâ€.

Good Utility stocks are hard to find because dividend-seeking investors have bid the prices up well beyond their fair valuations. Too often, investors evaluate stocks primarily based on dividend yield rather than looking at the underlying fundamentals first. This habit causes them to miss potential red flags. If the stock is overvalued, it will likely underperform, even with the dividend.