Flagstar Bancorp (FBC: ~$17.50/share) is in the Danger Zone this week. This Midwestern savings and mortgage bank has been consistently unprofitable since the financial crisis, yet accounting distortions allowed the company to report a sizeable profit last year. With headwinds on the horizon in the form of rising interest rates, it’s hard to see how FBC can turn around its business and achieve the consistent profitability that the market expects.

Lack of Profitability

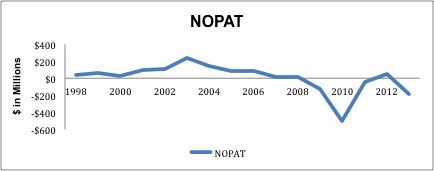

For the past five years, from 2009-2013, FBC’s operating results have been woeful. Its average after-tax profit (NOPAT) has been -$162 million and its average return on invested capital (ROIC) has been -9%. Figure 1 shows the drastic difference between FBC pre and post-2008.

Figure 1: FBC Net Operating Profit After Tax (NOPAT)

Sources:Â Â New Constructs, LLC and company filings

FBC managed to earn a small profit in 2012, but a sharp decline in loans originated in 2013 sent the company back into the red. FBC sells almost all of the mortgage loans it originates, so less loan originations mean less loan sales and less revenue.

Appearance of Profitability

Figure 2 shows the same NOPAT trend from Figure 1, but with GAAP net income overlaid. While NOPAT and GAAP net income have been similar for years, they diverged sharply in 2013. FBC’s GAAP net income was $247 million for the most recent fiscal year while its NOPAT was -$187 million.

Figure 2: Disconnect Between Income and NOPAT

Sources:Â Â New Constructs, LLC and company filings

Three key issues account for this discrepancy. One is well known and easy to spot on the income statement, but the other two are hidden and can only be found in the financial footnotes.

- Unusual Tax Benefit: FBC had a $343 million non-operating tax benefit due primarily to the reversal of the valuation allowance on its deferred tax assets. This item showed up on the income statement and was mentioned in the company’s fourth quarter conference call. The other two items were not so easy to spot.

- Decrease in Reserves: FBCÂ decreased its loan-loss allowance by $98 million in 2013, and this decrease artificially flowed into pre-tax income. Interestingly, FBC then turned around and increased this allowance by $100 million in the first quarter of 2014, which suggests they may have been using clever reserve accounting to meet their year-end numbers.

- Hidden non-operating income: FBC also recorded a $49 million gain due to the settlement of litigationwith Assured Guaranty (AGO).